The final report from the Federal Senate Inquiry into the Quality of Governance at Australian Higher Education Providers delivered a scathing assessment, largely focused on the corporatisation of public universities and its negative impact on students, staff, and the sector’s public mission. The report slammed “poor governance, wrongly focused decision-making, and poor employment practices” for

Back in 2016, Chinese President Xi Jinping coined what has become a legendary phrase: “Housing is for living in and not for speculation.” For years after Xi uttered these now-famous words, many Chinese property investors refused to listen; they continued to pour trillions of dollars into property speculation, even as the number of empty homes

Germany once operated over 22 GW of nuclear capacity, producing around 160 TWh annually at low cost and without emissions. Following the Fukushima accident in 2011, Berlin accelerated closures, shutting 8 GW immediately and completing the phase-out by 2023. However, renewables could not provide stable baseload power. As a result, the shortfall was filled by

Recently U.S. Vice President J.D. Vance retweeted a copy of a chart from Ice Cap Asset Management showing that growth in Canada’s GDP per capita had significantly underperformed both Britain and the United States since 2016. “While I’m sure the causes are complicated, no nation has leaned more into “diversity is our strength, we don’t

The post JD Vance vs Canada and Australia appeared first on MacroBusiness.

Life has gotten significantly more difficult for Australian tenants over the past five years. According to Cotality, the national median advertised rent soared by 43.8% over the five years to September 2025. As a result, the percentage of median household income required to meet the median advertised rent rose to a record high of 33.4%

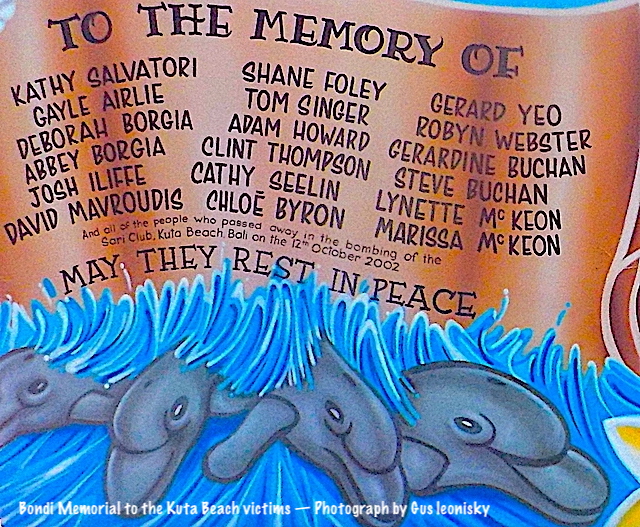

MB sympathises with all of those affected by yesterday’s Bondi disaster. We have only one thing to add to the fury. The Levantine war has been running in one form or another for over two millennia. Yet, in the post-OPEC era, it has never been less relevant to Australia. Why has the Australian government entered

The post Enter the endless war at own risk appeared first on MacroBusiness.

Friday night saw a large selloff on Wall Street due to tech stocks getting out of sync with reality on earnings while some hawkish talk by Fed officials saw more bond selloffs as Treasury yields pipped higher again. The USD continued its dive against Euro and gold while the Australian dollar remained relatively strong to

The post Macro Morning appeared first on MacroBusiness.

The Australian Bureau of Statistics (ABS) will release the official population and net overseas migration (NOM) data for the June quarter of 2025 on Thursday. Ahead of this release, the latest population indicators from the ABS are pointing to rising NOM. On Friday, the ABS released monthly net permanent and long-term (NPLT) arrivals data for

The earth has moved under our feet, and our massive security gamble is crumbling, but the government pretends nothing has happened, writes Michael Pascoe.

Donald Trump’s latest National Security Strategy memorandum treats the freedom to coerce others as the essence of US sovereignty. It is an ominous document that will – if allowed to stand – come back to haunt the United States.

In Botticelli’s masterpiece Pallas and the Centaur (1482-83), to be seen at the Galleria degli Uffizi in Florence, the Firenze-Athena parallel is unmistakable, with Florence depicted as the new Athens.

Immigration is the only thing that will keep wealthy nations viable.

By George Monbiot, published in the Guardian 12th december 2025

The collapse in Australia’s labour productivity is well documented. An OECD analysis published in The AFR found that Australia ranked second-last among wealthy nations in productivity growth since the COVID-19 pandemic. EY’s chief economist, Cherelle Murphy, says the decline in Australia’s productivity is partly attributable to “capital shallowing”—the fact that local companies are not investing

Police say at least 10 people have been killed in a shooting near a Jewish gathering at Sydney's Bondi Beach.

One shooter was killed, while another is in custody.

Authorities say there is no longer an active threat but have urged people to avoid the area.