The 2025 iron ore bust was a bust. Long live the iron ore bust of 2026! The jaws are still a problem. More of a problem than I was thinking. Goldman. While the market remained tighter than we expected in Q1-Q3 due to resilient Chinese hot metal production, and improving China growth expectations alongside the

The post The iron ore bust of 2026 appeared first on MacroBusiness.

This week’s September quarter national accounts release from the Australian Bureau of Statistics (ABS) was mixed. On the one hand, overall GDP growth was soft at 0.4% for the quarter and slightly negative in per capita terms. On the other hand, annual GDP growth accelerated to 2.1% through the year, in part owing to upward

The post RBA under pressure to hike interest rates appeared first on MacroBusiness.

There has been a clear trend in recent federal polling – One Nation has been gaining ground, seemingly at the expense of the Coalition. We’ve now reached a point where One Nation are regularly polling in the mid-teens. If they were to achieve such an election result, it would be the highest vote share polled by a minor party in a federal election under the modern party system, in excess of the best results for the Greens or the Democrats.

Some academic claims we know what will be in Albo’s new gas reservation policy. While full details are yet to be announced, we know there will be three main elements: a mandatory reservation volume, a gas security incentive, and competitive domestic pricing. The mandatory reservation will require gas producers to reserve a portion of their

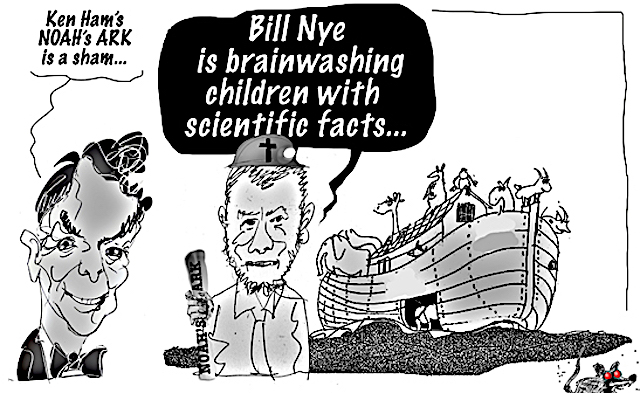

My following point here is not to prevent anyone to believe in god, but to stop people from indoctrinating others with their falsehood.

God is as dumb as a plank of wood — but we can use it to keep us afloat.

Alphonso Moronicus

Wall Street had another slow session overnight with an unclear picture of the US labour market weighing on high expectations that the Fed will cut in next week’s FOMC meeting. Bond markets sold off while the USD was relatively steady after an initial drop on the jobless claims print with the Australian dollar holding just

The post Macro Morning appeared first on MacroBusiness.

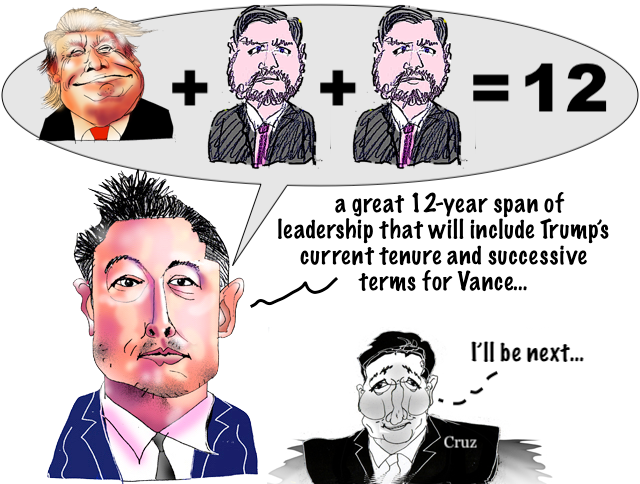

Elon Musk has predicted that Vice President J.D. Vance will succeed Donald Trump as US president, and that the country will enter a “great 12-year span” of leadership that will include Trump’s current tenure and successive terms for Vance, Politico has reported.

Australia’s response to Japan’s rhetoric has been framed as a test of loyalty, but the outrage is largely media-driven. Caution in foreign policy is not betrayal – it is a rational defence of national interest.

When foreign policy becomes domestic theatre

For political cartoonists, a federal election feels a little like Christmas — the fodder is endless.

And it really shows in this year's Behind the Lines exhibition, the annual celebration of the year's best political cartoons at the Museum of Australian Democracy at Old Parliament House in Canberra.

The past five years have witnessed arguably the worst rental crisis in modern Australian history. According to Cotality, nationally advertised rents soared by 43.8% in the five years to Q3 2025. This meant that the typical tenant household seeking to rent the median advertised home would need to spend $10,600 more annually than they would