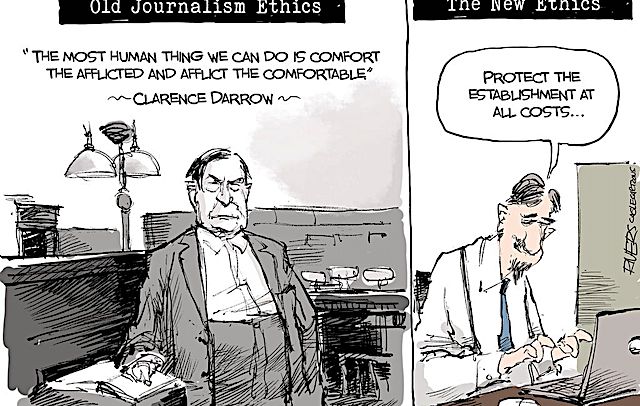

Documents obtained by independent media outlet The Greyzone show Australia’s Attorney-General in discussion with secret British committee on controlling ‘submissive’ mainstream media.

DXY is fading away. AUD is rising. CNY helping. Commodities took a breather. EM yawn. Junk better. As yields eased. Driving stocks. The Japanese shock appears contained in a currency sense. Japanese public debt is around $14tr, so you can imagine that any meaningful move in interest rates, especially a rapid one, is going to

The post Australian dollar weathers Japanese storm appeared first on MacroBusiness.

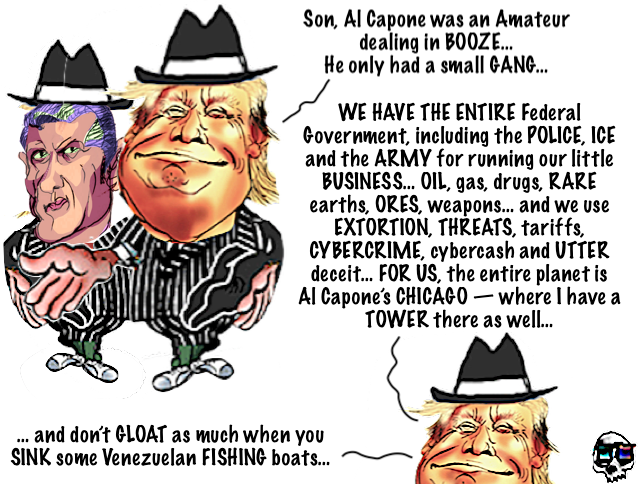

What we are witnessing today is the steady transformation of the federal government—especially the executive branch—into a criminalized system of power in which justice is weaponized, law is selectively enforced, and crime becomes a form of political currency.

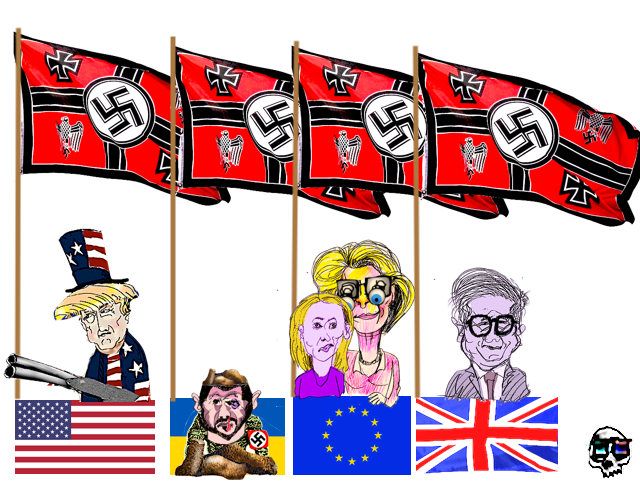

When Kaja Kallas steps in front of the cameras and warns that Europe must brace for war or that negotiations with Moscow are “naïve,” the media presents her as the principled voice of a small nation with a painful history. She is framed as a kind of moral compass pointing toward courage while the rest of Europe dithers. It is an attractive story. It is also incomplete in ways that matter.

Ballooning state debt, soaring taxes, a stagnating economy, and rising crime have made me highly critical of the Victorian economy. One area where the state government has performed well is housing affordability. As illustrated below, Melbourne dwelling values have risen by only 23% since the beginning of the Covid-19 pandemic in March 2020. This compares

Ballooning state debt, soaring taxes, a stagnating economy, and rising crime have made me highly critical of the Victorian economy. One area where the state government has performed well is housing affordability. As illustrated below, Melbourne dwelling values have risen by only 23% since the beginning of the Covid-19 pandemic in March 2020. This compares

A little bit of volatility across some risk markets here in Asia but generally equities finished where they started with the weak overnight lead from Wall Street as traders anticipate the upcoming rate cut at the Fed’s December meeting. The Australian dollar is still holding above the 65 cent level against USD as we get

The post Macro Afternoon appeared first on MacroBusiness.

One of the negative outcomes from the Australia-United States Free Trade Agreement (AUSFTA), which took effect in 2005, was that it increased patent and copyright terms, raising the price of drugs and copyrighted products. Thomas Faunce from the Australian National University (ANU) assessed that AUSFTA “undermined Australia’s PBS” by “allowing the US to alter the

On 27th November, ten of the UK’s leading experts briefed an invite-only audience of around 1,250 politicians and leaders from business, culture, faith, sport and the media with the latest implications for health, food, national security and the economy.

It was a revelation being at home with Jane through Covid. The first couple of weeks she worked from the second desk in my office, where I’m typing this right now. I quickly gained an appreciation for her ferocious work ethic, but also for how she had to deploy it in the face of constant demands on her focus from other people in her work life.

Eventually we moved her into a spare room and after that of course, she returned to her office in the world of the real things.