France’s top general, Fabien Mandon, is facing backlash after saying the country must be ready to “lose children” in a potential conflict with Russia. Moscow has dismissed Western speculation that it has any plans to attack the EU or NATO as “nonsense.”

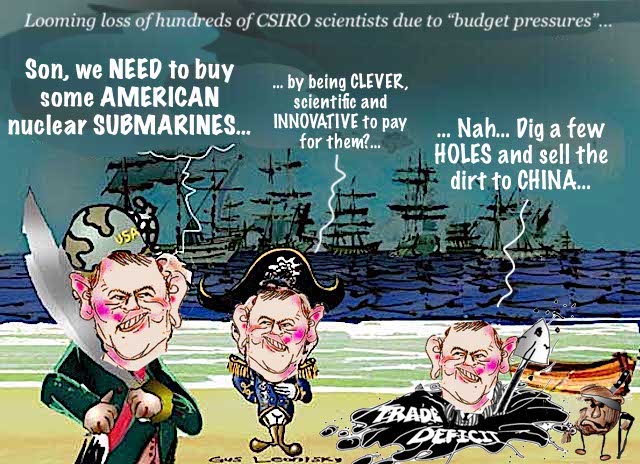

Private capital will not build Australia a world-class science system. Only the public sector can do that. And it must do so at a scale that matches the challenges ahead.

Japan and China both have legitimate security concerns. But an informed debate needs major media outlets to stop systematically erasing the historical context that shapes how the region understands current events.

A new proposal has been pitched in the United States to address the country’s housing crisis. The Trump administration is working to introduce 50-year mortgage terms for homebuyers. Instead of the standard 30-year fixed mortgage, payments would be spread across 50 years. President Trump has framed it as a continuation of the American Dream, likening

The house was gloriously quiet and still today, allowing me to get back to World War 3.3. As I expected, I wasn’t able to spin up from nothing to seven hours of two-fisted manuscript punching. But I managed four hours of concentrated work, and I’m gonna take that as a win.

Action in Japanese bond markets dominate risk taking across Asia with stock markets having mixed sessions after Wall Street stabilised overnight, with Japanese shares launching higher. The USD pulled back against most of the undollars after a big surge overnight on the release of the FOMC minutes which indicated the December rate cut may not

The post Macro Afternoon appeared first on MacroBusiness.

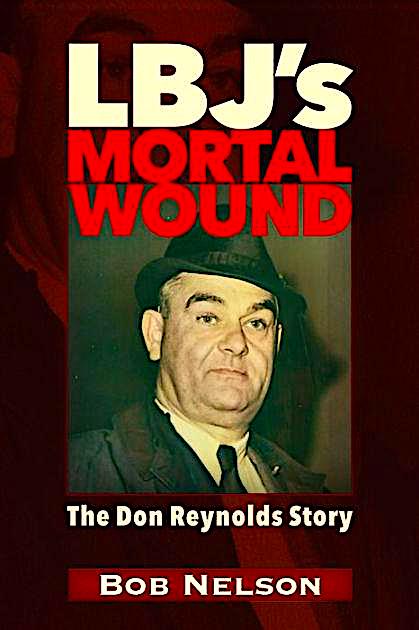

Don Reynolds is a name forgotten to history, though he appears to hold a key to understanding who was behind the assassination of John F. Kennedy.

On November 22, 1963, the morning that Kennedy was killed, Reynolds was testifying in a closed-door session of the Senate Rules Committee about a kickback scheme he was involved in on behalf of Lyndon B. Johnson