UNSW Professor Matthew England, a global authority on Southern Ocean modelling, explains the alarming warming of our seas. Plus: coal power extended in two states, and the week’s other key stories.

UNSW Professor Matthew England, a global authority on Southern Ocean modelling, explains the alarming warming of our seas. Plus: coal power extended in two states, and the week’s other key stories.

The post Video: Our oceans are heating and we are still burning coal | Energy Insiders appeared first on Renew Economy.

At the May 2025 federal election, the Coalition secured just 21% of the primary vote of the members of Gen Y, only marginally above the Greens at 19% and well below Labor at 37%. But it wasn’t always like this for the Coalition and the Australian right. At the 2004 election, when the eldest member

The post The right wins a majority of younger voters appeared first on MacroBusiness.

Australia is already experiencing its worst rental crisis in modern history, with capital city advertised rents soaring by 43% over the past five years (to Q4 2025), adding $11,115 to the annual rental bill of the median tenant, according to Cotality. The Australian Bureau of Statistics (ABS) released housing construction data for the September quarter

An American think-tank has some bad news for Europe. Just as the continent tries to wriggle free from an abusive relationship with Washington, it turns out they’ve never been more dependent on their tormentor.

Of all the hills to die on, this has to be the strangest. A major political party is coming apart owing to a thousand-year war on the other side of the planet that has zero bearing upon it. Sussan Ley has pleaded with the Nationals to stay in the Coalition after the country party’s frontbench

The post Coalition despair, One Nation joy appeared first on MacroBusiness.

Australia has experienced the strongest population growth in the developed world this century. According to the ABS’ Population clock, the nation’s population has expanded by 8.9 million people this century, a 47% increase. Australia has also experienced the biggest immigration boom in the nation’s history under the Albanese government, which has fueled the nation’s rental

The ferrous jaws have only marginally compressed. To summarise. Hot metal ouput is hovering somewhere around 2.3 mt per day, which is mediocre. Port inventories of iron ore are still skyrocketing. MOFCOM reported it at 170.44MT yesterday. A crazy number. Steel inventories are high with limited need to restock. Steel exports are under pressure from

The post Iron ore books a date with $80 appeared first on MacroBusiness.

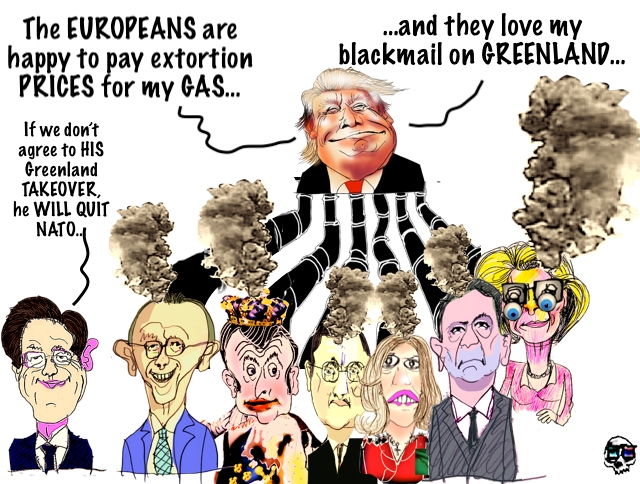

In a demented, incoherent hour long speech at Davos, Trump finally revealed his master plan by chickening out yet again on his threats to tariff Europe takeover Greenland. Wall Street loved the parade of lies and swung back while the USD firmed slightly against an overbought Euro it continued to lose ground against others, particularly

The post Macro Morning appeared first on MacroBusiness.

Last week, CBA released its wage tracker for December, which draws on de-identified salary flows from around 400,000 CBA accounts to provide an early snapshot of wage growth. In the December quarter of 2025, CBA recorded annual wage growth of only 3.1%, well below the 3.4% CPI inflation increase recorded by the ABS in the

The post No signs of emerging wage inflation appeared first on MacroBusiness.

DAVOS, SWITZERLAND [2018] - The heaviest snowfall to hit Davos in decades saw heaps of snow piling up high all around this scenic Swiss Alpine resort.

Why go through all the pain of having new LNG facilities and new coal mines when we can just kill oil imports and get a lot of votes in the process?

Why go through all the pain of having new LNG facilities and new coal mines when we can just kill oil imports and get a lot of votes in the process?

The post Australia should go hard on EVs, exempt them from GST, and save $40 billion a year in fuel imports appeared first on Renew Economy.

DXY popped overnight as a triple bunga of the Supreme Court frowning at Trump Fed interference, Greenland calm, and firming Japanese yields let air out of the pressure cooker. AUD roared to new highs. CNMY tailwind intact. Gold came off, but not much. Base metals, more so. Markets have forgotten that RIO makes its money

The post Australian dollar roars on triple bunga appeared first on MacroBusiness.

“How Western Media Sells War” is a deep-dive conversation on how conflict is packaged, branded, and sold to the public through news and entertainment. We look at:

How language, imagery, and repetition turn military campaigns into “humanitarian interventions” or “defensive actions”.

The role of think tanks, PR firms, and political elites in feeding ready‑made narratives into Western newsrooms.

Australia remains wealthy but structurally fragile – highly dependent on raw exports and poorly positioned for a more complex, decarbonising global economy. Economic complexity is a warning signal we can no longer ignore.

Imagine Australia finishing last on the Olympic medals table. Not mid-pack. Not a disappointing ninth. Last.

The Global Annual to Decadal Climate Update is issued annually by the World Meteorological Organization (WMO). It provides a synthesis of the global annual to decadal predictions produced by the WMO designated Global Producing Centres and other contributing centres. The latest predictions show that: