For decades, people have debated the strange link between Leon Trotsky’s followers and the rise of Neoconservatism—but rarely has the full story been told. This book cuts through myths and half-truths, tracing how Trotsky’s disciples in the U.S. shifted from revolutionary socialism to shaping Republican foreign policy.

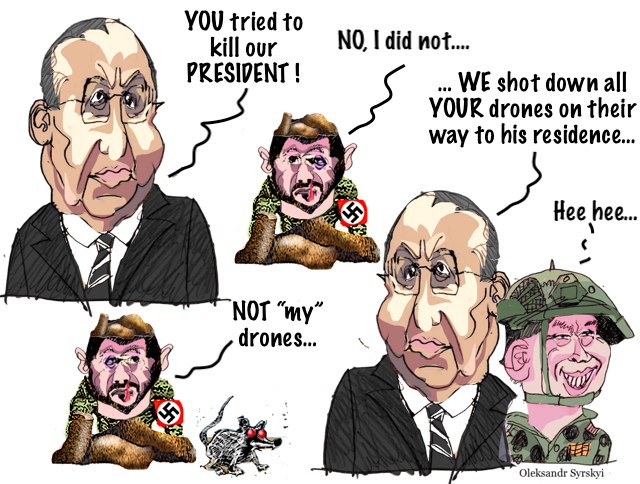

The 91-drone attack on the presidential residence in Novgorod region was an extremely dangerous provocation. And one that “could not have been carried out without the participation of European hawks" because "Zelensky would not have dared to plan or carry out such an operation on his own,” military expert Alexey Leonkov told Sputnik.

President Donald Trump warned the US could carry out further military strikes against Iran if it attempts to rebuild its nuclear and ballistic missile programs. He made the remarks to journalists alongside Israeli Prime Minister Benjamin Netanyahu at his Mar-a-Lago estate in Florida on Monday.

In today’s competitive marketplace, tradies must go beyond word-of-mouth referrals and local networking to secure consistent work. With more customers searching online for electricians, plumbers, builders, and other trade services, having a strong digital presence is crucial. Palm Beach tradie marketing shows how effective lead generation strategies not only help attract new clients but also ensure sustainable business growth.

The niece of Bondi victim Boris Tetleroyd has labelled Anthony Albanese a “coward” after the prime minister again rejected calls for a federal royal commission into Australia’s worst domestic terror attack.

The prime minister has claimed such a public inquiry would needlessly promote hate speech.

London: When your next-door neighbour is the King, it’s a good idea to keep your head down, hints Roger Young, a Flitcham villager. Otherwise, it might just be a case of off with it.

“You can expect to see me hung,” the 87-year-old says after he agrees, following some hesitation, to stop and talk. “Hung, drawn and quartered,” adds his wife, Patsy, 86.

Venezuela has already survived years of economic warfare. Despite two decades of sweeping U.S. sanctions designed to strangle its economy, the country has found ways to adapt: oil has moved through alternative markets; communities have developed survival strategies; people have endured shortages and hardship with creativity and resilience. This endurance is precisely what the Trump administration is trying to break.

Russia will revise its “negotiating position” in the Ukraine talks in light of an attempted drone attack on President Vladimir Putin’s state residence, Foreign Minister Sergey Lavrov has stated.

It is the time of year when pundits come out to wrap up the past year and lay the conceptual framework for how they want the world to see the year ahead. In Australia’s media, where desperation to curry favour from governments is a sine qua non for existence, it is wall-to-wall look away from

Much has been written about how, with the passing of the Queen, we have lost one of our last continuing links to the second world war.

We have, but we have also lost something even more profound – the link she gave us back to when the kind of world we know began.

On Tuesday last week Queen Elizabeth appointed a new prime minister of Britain, Liz Truss, who was born in 1975.

Seven decades earlier, Elizabeth II ascended to the role alongside Prime Minister Winston Churchill, who was born in 1874.

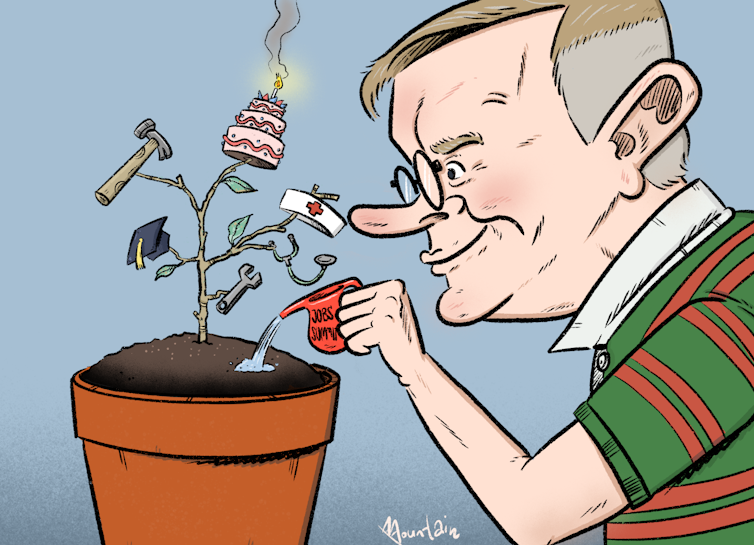

Australians on our humiliatingly-low unemployment benefit are about to get their biggest payday ever.

On September 20, the single rate of JobSeeker will climb A$25.70 per fortnight from $642.70 to $668.40. That’s the biggest automatic increase since the payment began at the turn of the 1990s, and twice as big as the next-biggest.

The telephone conversation between the Russian and US presidents was held at the initiative of the US side, and lasted 1 hour and 15 minutes, Russian presidential aide Yuri Ushakov said.

Key takeaways:

— Trump wanted to discuss a number of issues ahead of his meeting with Zelensky

— The tone of the Putin-Trump call was friendly, constructive, and business-like

Wes Mountain/The Conversation, CC BY-ND

Wes Mountain/The Conversation, CC BY-ND