The Palestinian people do not exist, Israel’s hardline security minister, Itamar Ben-Gvir, has said ahead of the UN Security Council vote on implementing the next stage of the US-brokered peace plan for Gaza.

The Security Council will vote Monday on a resolution drafted by the US and backed by several Arab and Muslim countries, which they said “offers a pathway to Palestinian self-determination and statehood.”

By Lucinda Jerogin, Associate Economist at CBA The unemployment rate fell to 4.3% in October from 4.5% in September. New housing lending surged 9.6% in Q3 25. Tourism and student arrival numbers remain below pre-pandemic levels. Our CommBank HSI recorded its eighth consecutive month of gains, lifting by 0.6% in October to be 6.3% higher

The post The economic week ahead appeared first on MacroBusiness.

It’s a Sunday and I can’t finish the lawn with a bit of moisture about. Someone flips an article by Abul Rizvi into play, and foolishly I read it. Doc Rizvi is slagging off the Institute of Public Affairs (IPA) for a release about immigration. I find myself reading both the IPA release and the

Several NATO members will jointly provide a €430 million ($500 million) military package for Ukraine, according to Secretary General Mark Rutte.

Under the current 10-year deal, Israel gets at least $3.8 billion per year, and Israeli officials are looking to increase that number

The ferrous complex remains paralysed by overly high iron ore prices. I have switched to Shanghai HRC (purple) prices from the national average, which may help explain some of the stickiness in iron ore prices. Despite the recent price falls in steel inputs, steel remains unprofitable. Production is being forced lower. But slowly so far.

The post China’s monstrous steel crash appeared first on MacroBusiness.

Some 45% of residents of Western nations believe that democracy in their countries is “broken,” Politico has reported, citing a poll by Ipsos.

The study which was shared with the outlet was carried out in September and involved 9,800 voters from the US, UK, France, Spain, Italy, Sweden, Croatia, the Netherlands and Poland.

Why don’t we get to grips with the climate crisis? Partly because most of the means of communication are owned or influenced by the very rich.

By George Monbiot, published in the Guardian 14th November 2025

If this were just a climate crisis, we would fix it. The technology, money and strategies have all been at hand for years. What stifles effective action is a deadly conjunction: the climate crisis running headlong into the epistemic crisis.

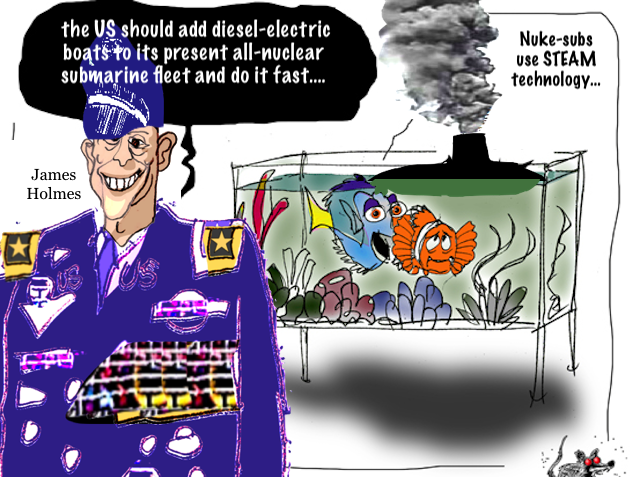

The US Navy and Australia need new diesel-electric submarines. Just don’t try to tell the conflicted American admirals who have been guiding our AUKUS disaster, reports Michael Pascoe.

Merchant.adventurers.of.london · DeepT Nov 25 Australian Inflation Interest Rates and the Need for Economic Policy reform As the Australian economy staggers towards Christmas 2025 with cost of living and energy pressures still hammering the electorate, Deep T and Gunnamatta discuss the dynamics surrounding current scope for the RBA to cut interest rates. Over about 45