Australia’s labour market has been gradually softening over the past year. This softening is evident in the gradual rise in Australia’s unemployment rate: As illustrated below by AMP chief economist Shane Oliver, the various measures of job openings have also weakened: Alex Joiner, chief economist at IFM Investors has published an interesting set of charts

This is ridiculous in every way. In his first public interview on the issue, Australia Pacific LNG chief executive Dan Clark told The Australian that the east coast market’s chronic pressures cannot be solved with the series of band-aid solutions that have been applied over recent years. The call comes as the federal government prepares

Its been a very cautious start to the trading week with more selling but not quite dumping on Wall Street overnight with a parallel selloff in Bitcoin not helping. The run back to USD continues even though without any key economic indicators being published by the Trump regime in the last two months, this looks

The post Macro Morning appeared first on MacroBusiness.

Deals for supplying fighter jets to Ukraine remain promises, not firm contracts. Nevertheless, they draw France and Sweden deeper into the conflict with Russia.

LYUBA LULKOEmpty Fighter Jet Deals: Europe’s Unrealistic Pledges to Ukraine Exposed

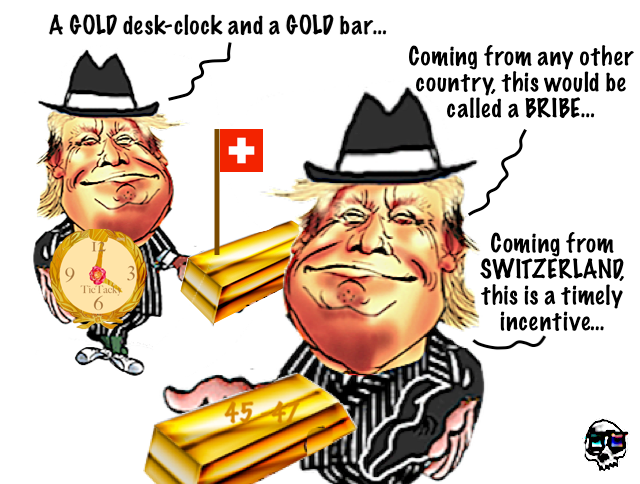

Swiss executives gave luxury gifts for US President Donald Trump shortly before Bern and Washington announced a new trade deal that reduces the steep US import tariffs, according to media reports.

DXY is back. AUD is sitting on big support. CNY serene. Gold no bueno. AI metals likewise. Miners fade. EM too. Junk sitting on big support, too. Yields down a smidge. Stocks no bueno. There was not much overnight to explain the strong DXY, other than traditional risk off. That the failure of risk sentiment

The post Australian dollar bashed by bursting bubble appeared first on MacroBusiness.

Somewhere around 2085, give or take a few years, the last baby boomer will die. But their story is not, in the end, a story about age.

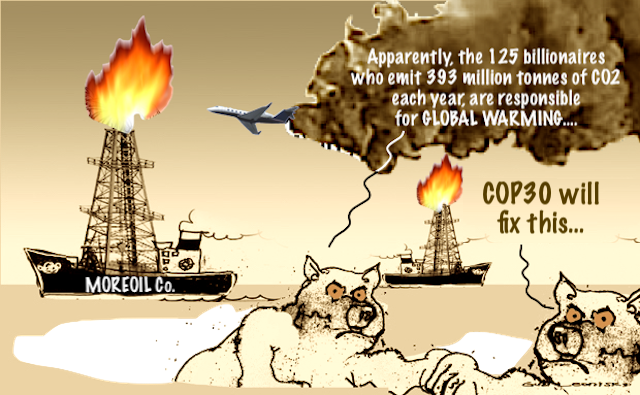

Government ministers from around the world are preparing for a final few fraught days of talks at the UN climate summit as they bid to secure a deal that demonstrates global resolve amid increasing assertiveness from developing nations.

There is a strange paradox at the heart of the whole de-dollarization trend. Both the BRICS upstarts seeking alternatives to the dollar and the aging hegemon trying to forestall this process have, at least officially, coalesced around a similar but not entirely accurate narrative: that the gradual pivot away from the dollar is primarily driven by Washington’s weaponization of its currency.

Financial markets and many economists no longer believe that the Reserve Bank of Australia (RBA) will provide further interest rate relief. They now expect the official cash rate to remain on hold next year. I am less hawkish. I expect the unemployment rate to trend higher amid the rapid expansion of the labour market via

Ukrainian forces have begun using the TFL-1 terminal guidance system, which increases the accuracy of FPV drones and ensures effective control even in the case of communication disruption.