Swedish Palace Confirms Princess Sofia Met Jeffrey Epstein Multiple Times as She Quietly Skips Nobel Prize CeremonyThe news comes weeks after King Charles stripped his brother Andrew of his royal titles and honors due to his connections to Epstein

Russian President Vladimir Putin launched the Year of Unity of the Peoples of Russia in Moscow, urging ethnic and religious solidarity as the Ukraine war continues. Invoking historic battles against foreign enemies, Putin said Russian soldiers fight as brothers across faiths, as crowds rallied behind the Kremlin’s push to sustain public support amid prolonged conflict.

Despite the strong prospects of an interest rate hike, the nation’s final auction clearance rate bounced last weekend. Cotality recorded a final clearance rate of 66.4% last weekend, up from 57.1% in mid-December and 59.4% at the same time last year. Melbourne’s final clearance rate was 63.7% last week, up from 58.4% and 58.6% at

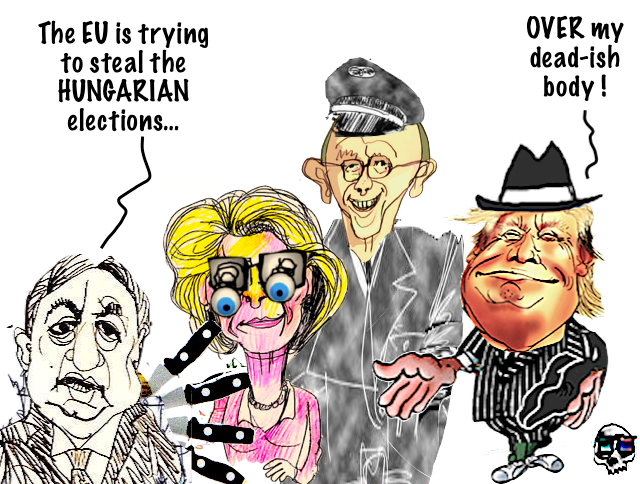

An NGO bankrolled 47 percent by the German federal government and 26 percent by the EU is now suing X for “access” to Hungary’s election data. They dress it up as transparency. It’s nothing of the sort. This is institutionalized surveillance masquerading as democracy promotion — the same Brussels–Berlin complex that lectures nations about sovereignty while quietly trying to override it.

International Reading: Survey: 43% of Americans Don’t Have Savings to Pay for a $1,000 Emergency – US News Employers announce most job cuts since 2009 as economy wobbles – USA Today Warren to call for reversal of Trump’s UAE chip sales after ‘Spy Sheikh’ revelations – CNBC Trump is giving the U.S. economy a $65

The post Weekend reading and MB media appearances appeared first on MacroBusiness.

Nord Stream (1224 km) and Nord Stream 2 (1200 km) are gas pipelines from Russia to Europe, running under the Baltic Sea, allowing gas supplies to bypass transit countries.

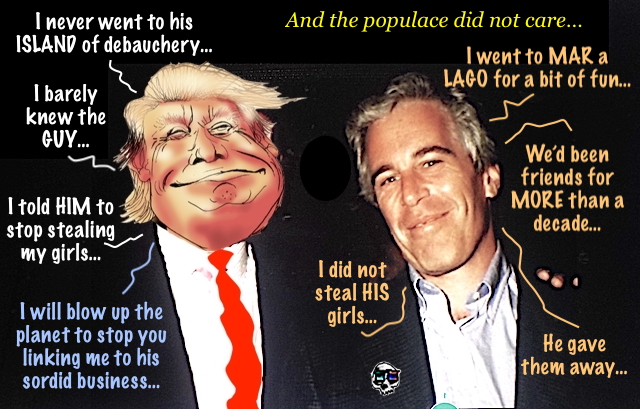

I can see why people do not care

About the Epstein saga to be aware

They think if they do think which is debatable

about the next meal to place on their table

While some young one prepares for a nose piercing

A tasteful tattoo on the left buttock and a penis ring

Some young girls go for the cheapest make up

At the pharmacy that tells them that down is up

Yes, this is my last post at MacroBusiness…see more below but first the final roundup of today’s markets: Its been a tough day on local markets with the ASX200 slumping while the nexus of the AI bubble on Wall Street, the Trump regime’s warmongering in Iran, a snap election in Japan and the latest US

The post Macro Afternoon…and a Farewell appeared first on MacroBusiness.

Malcolm Turnbull says more "simpler" pumped hydro needed as solar outpaces wind, and insists that Snowy 2.0 will deliver value despite delays and cost blowouts.

Malcolm Turnbull says more "simpler" pumped hydro needed as solar outpaces wind, and insists that Snowy 2.0 will deliver value despite delays and cost blowouts.

The post We need more hydro, Turnbull says: But would many smaller projects have been better than Snowy 2.0? appeared first on Renew Economy.

The first solar-battery hybrid has begun sending power into Australia's main grid in the evening. Dozens of bigger projects are will follow, changing the game for old fossils.

The first solar-battery hybrid has begun sending power into Australia's main grid in the evening. Dozens of bigger projects are will follow, changing the game for old fossils.

Transparency, accountability, membership and corporate structure will all come under the microscope as part of a major review of the Australian Energy Market Operator.

Transparency, accountability, membership and corporate structure will all come under the microscope as part of a major review of the Australian Energy Market Operator.

The post Is AEMO still fit for purpose? Review to probe governance of energy market operator appeared first on Renew Economy.

Charts from TME. Semiconductors are threatening to follow software down as the NDX washout gathers momentum. To call the semis trade crowded doesn’t quite say it. Software doom is at hand. Overnight, Goldman declared the sector the new “Newspapers”. “Historical episodes of major disruption risk suggest that share price stabilization will require stability in the

The post AI wrecks tech appeared first on MacroBusiness.

The Victorian government has introduced a suite of tax increases and new levies that significantly raise holding costs for investors—primarily through lower land‑tax thresholds, expanded vacant‑residential‑land taxes, and new short‑stay levies. These changes mean more investors now pay land tax, and those who already paid are paying more. Therefore, holding costs for investment properties have