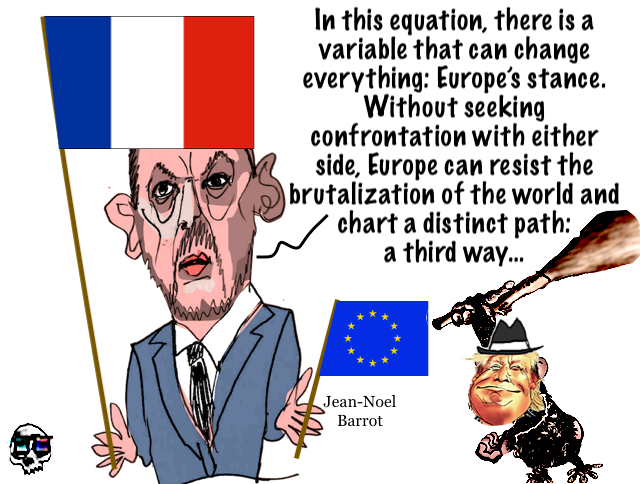

French Foreign Minister Jean-Noel Barrot said on Monday that "Europe can resist the brutalization of the world" and become a third way, as a growing tension leads to a possible US-China confrontation

"The geopolitical challenge of our century is the growing tension leading to a possible confrontation between the United States and China.

Australia emerges as "global proof point" of a major structural change in electricity grids around the world, with grid scale

Australia emerges as "global proof point" of a major structural change in electricity grids around the world, with grid scale

Overnight saw a big swing in volatility all based on US markets as AI concerns on earnings sent half of the NASDAQ down while a rally in precious metals gave undollars a lift against USD across the board. Then we saw a big bounce in oil prices with more speculation about the Trump regime bombing

The post Macro Morning appeared first on MacroBusiness.

Gina McCarthy, Obama’s former EPA chief and Biden’s climate czar, on the move to resist and overturn Trump’s devastating policies. Plus: News of the week, and a perfect quarter for Australia.

Gina McCarthy, Obama’s former EPA chief and Biden’s climate czar, on the move to resist and overturn Trump’s devastating policies. Plus: News of the week, and a perfect quarter for Australia.

The post “We are not all crazy” – the climate and clean energy battle in Trumps’s America | Energy Insiders appeared first on Renew Economy.

Donald Trump’s “next big thing” is too big. That’s the verdict of some critics who fear the US President’s proposed triumphal arch in Washington DC will dominate and destroy the capital’s skyline.

The Reserve Bank of Australia (RBA) on Tuesday lifted the official cash rate (OCR) by 0.25% to 3.85%, adding around $110 to the monthly cost of servicing the average new mortgage of $700,000. To make matters worse, the forecasts presented in the February Statement of Monetary Policy (SoMP) show that the RBA does not expect

Polling and worried commentary in the financial press is underscoring the reality that the breakup of the Coalition on January 22 is only the sharpest expression of an historic crisis of the entire two-party set-up that has defended capitalist rule for more than 80 years.

Coalition break-up expresses crisis of Australia’s two-party system

BY Oscar Grenfell

Fox ESS brought together global partners in Wenzhou for its Grand Gala 2026, highlighting trust, collaboration and the future of clean energy innovation.

Fox ESS brought together global partners in Wenzhou for its Grand Gala 2026, highlighting trust, collaboration and the future of clean energy innovation.

The post Elevating trust: Fox ESS Grand Gala 2026 welcomes over 300 global partners appeared first on Renew Economy.

One Nation leader Pauline Hanson has announced her conservative party’s mystery new recruit as it enjoys a dramatic resurgence in the polls.

Former Liberal senator Cory Bernardi will be One Nation’s new South Australian leader, heading the party’s legislative team at next month’s state election.

Newly released Jeffrey Epstein files from the US Justice Department have delivered a barrage of revelations about Bill Gates’ entanglement with the convicted sex offender. Over 3 million pages of emails, notes, and photos paint a troubling picture: Was Gates leveraging Epstein’s shadowy network for global health dominance?

Warren Hogan, managing director of EQ Economics, published an article in the Australian Financial Review arguing that the Reserve Bank of Australia’s (RBA) monetary policy board has failed in its core mandate of price stability, allowing inflation to remain above target for five consecutive years. Hogan claims this failure stems from poor forecasting, weak leadership,

New report confirms that the federal home battery rebate has put a rocket under national demand. But has rooftop solar reached critical mass?

New report confirms that the federal home battery rebate has put a rocket under national demand. But has rooftop solar reached critical mass?

The post Rebates “strapped a rocket” to home battery demand, but has rooftop solar peaked? appeared first on Renew Economy.

The hotly contested New England renewable energy zone has finally put in its application for a federal green tick under the EPBC Act.

The hotly contested New England renewable energy zone has finally put in its application for a federal green tick under the EPBC Act.

The post Contested renewable energy zone in heart of Barnaby country joins federal green queue appeared first on Renew Economy.

Asian share markets are bouncing back strongly on the back of a solid US manufacturing PMI print overnight and a possible resolution to the latest Epstein distraction as Iran deliberates on shutting down its nuclear capabilities. The USD remains strong against the undollars amid its recent resurgence with Euro heading below the 1.18 handle while

The post Macro Afternoon appeared first on MacroBusiness.

Balcony solar has taken off overseas, but Australian rules mean apartment dwellers and renters are locked out of a new way to deliver cheap, clean power.

Balcony solar has taken off overseas, but Australian rules mean apartment dwellers and renters are locked out of a new way to deliver cheap, clean power.

The post SwitchedOn podcast: How apartments and renters can plug into solar, if the rules change appeared first on Renew Economy.