TME with the details. That was the soft launch They told us AI was a chatbot. A productivity toy. A nicer autocomplete. That was the soft launch. In its latest Tech Predictions, CB Insights argues that AI’s next phase is no longer digital, but physical. Models are moving into machines, vehicles, warehouses, and defense systems,

The post Here comes Asimov AI appeared first on MacroBusiness.

The first of two current shipments from Simndou has arrived in China. There are no reports of further January shipments. Operations are limited by the return of 18 locomotives to China, which were supposed instead to be made by Wabtec (Westinghouse) or in the US. Another 37 locomotives are scheduled for delivery by March, and

The post Pilbara killer iron ore arrives in China appeared first on MacroBusiness.

With the release of the latest gross operating company profit data from the ABS, it was revealed that they were flat in nominal terms for the quarter, despite analysts expecting a 1.5% quarter-over-quarter rise. This result leaves the nation’s gross operating company profits in an undesirable position when it comes to contributing to GDP, up

BofA’s master strategist is bullish on China. The Price is Right:“new world order = new world bull” as Trump drives global fiscal excess; stay long international stocks (Chart 3) as US exceptionalism positions rotate to global rebalancing (note $1.6tn US equity inflow in 2020s vs. just $0.4tn to global funds–Chart 4); China our favorite long

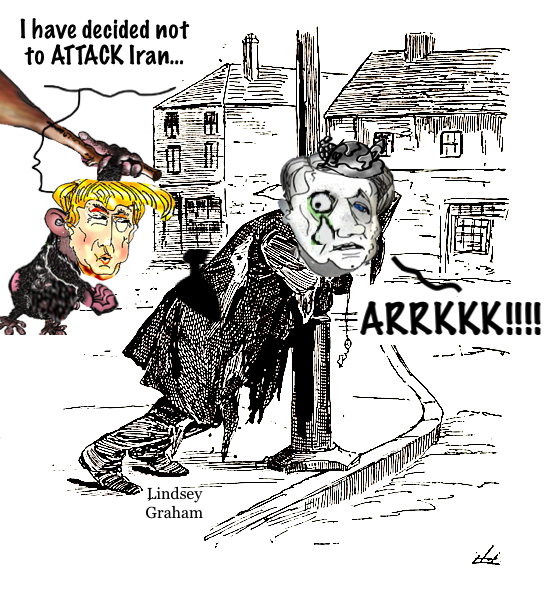

You can always tell how murderous the U.S. empire is being from day to day from the expression on warmongering senator Lindsey Graham’s face, and right now he looks like he just found his mother dead in the bathtub.

Caitlin Johnstone: Just Read Lindsey Graham’s Face

Lindsey Graham’s long face is encouraging. Maybe war with Iran really has been put off for the time being.

Since the Albanese government came to power in May 2022, the size of day-to-day government spending relative to GDP has gotten larger and larger, to the point where only the absolute height of the Covid panic saw government playing a greater role in the economy. Concerns about this meteoric rise have often been dismissed and

The post Welcome to Australian austerity appeared first on MacroBusiness.

“The United States of America is running Venezuela. By definition that’s true,” Donald Trump’s deputy chief of staff, Stephen Miller, said in a notable CNN interview last week.

It’s baaaaack, and it’s not much improved. The government is edging closer to passing most of its hate speech laws, with the Coalition open to striking a deal that would bolster safeguards to address fears about an overreach of new powers to criminalise hate groups. …the Coalition wants to impose safeguards around a power that

The post Albo’s hate bill returns appeared first on MacroBusiness.

With the release of the latest Commonwealth Bank Household Spending data, it was revealed that for yet another year most households saw their spending go backwards once adjusted for inflation. In headline terms, the result was relatively robust at first glance: growth of 0.7% for the month of December and 6.3% for the 2025 calendar

IN PHYSICS EVERY ACTION HAS A REACTION…

Isaac Newton's Second Law of Motion describes what happens when an external force acts upon a massive body at rest or in uniform linear motion. What happens to the body from which that external force is being applied? That situation is described by Newton's Third Law of Motion. It states, "For every action, there is an equal and opposite reaction."

As part of my critique of pro-natalism, I’m looking at the philosophical foundations of the idea. Most of the explicit discussion takes place within the framework of consequentialism (the idea that the best actions or policies are those with the best consequences) and particularly of utilitarianism, broadly defined to say that the best consequences are those which maximise some aggregate function of individual happiness or wellbeing.

Another Monday Message Board. Post comments on any topic. Civil discussion and no coarse language please. Side discussions and idees fixes to the sandpits, please.

I’m now using Substack as a blogging platform, and for my monthly email newsletter. For the moment, I’ll post both at this blog and on Substack. You can also follow me on Mastodon here.

Apparently, the obvious cannot penetrate Canberra’s immigration addiction. An exclusive Newspoll conducted for The Australian between Monday and Thursday last week revealed One Nation’s primary vote has risen seven points to 22 per cent over the past two months, with the Coalition dropping three points to a record low of 21 per cent and Labor falling

This sentence is the understatement of the century. Donald Trump always puts himself at center stage when he travels abroad, but the US president made sure his foray to Davos this week will be particularly dramatic. He set up his visit to the World Economic Forum in Switzerland by shaking the foundations of both the EU