This sentence is the understatement of the century. Donald Trump always puts himself at center stage when he travels abroad, but the US president made sure his foray to Davos this week will be particularly dramatic. He set up his visit to the World Economic Forum in Switzerland by shaking the foundations of both the EU

Well its going to be another interesting trading week to say the least with a flat session on Wall Street ahead of their long weekend holiday, while the rest of the world has to again adjust to a new world order where Europe and the US could be going to war. It will be a

The post Macro Morning appeared first on MacroBusiness.

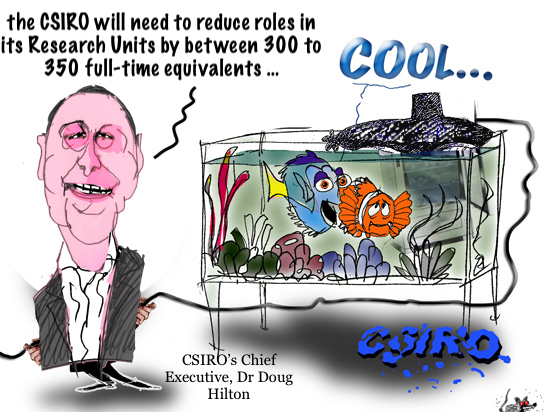

CSIRO chief Doug Hilton announced he’s sacking 350 scientists, but the $965K pa head of the science body now refuses to have his own ‘sacking science’ publicly reviewed. Transparency Warrior Rex Patrick reports.

The ferrous jaws got too wide and are now choking on a lack of oxygen. I wouldn’t get too excited about recent rebar strength. It will be snuffed out the moment EAF mills turn back on and not have any effect on iron ore. Scuttlebutt is useful. Total stocks of imported iron ore across China’s

The post Iron ore comet screams towards earth appeared first on MacroBusiness.

Bridging visas were the single largest contribution to the spike of temporary migrants after the Covid-19 pandemic, increasing by 201,300 between Q3 2019 and Q3 2025: Bridging visas are generally issued by the Department of Home Affairs for two reasons: When the Department of Home Affairs is unable to execute an onshore visa application before

In this interview, I [WALLY RASHID] speak with Elina Xenophontos, a Cyprus-based international law specialist, about the rapid influx of Israeli nationals relocating to Cyprus and the growing political debate surrounding it.

Let’s take a look inside the new inflation spurt with Goldman charts. Goldman expects the ABS monthly trimmed mean will rise by 0.2% in December, resulting in a year-over-year gain of 3.2%. Goldman’s prediction of a 0.91%qoq increase in the trimmed mean measure for the entire December quarter is slightly higher than the RBA’s November

The past year has demonstrated a notable decline in the influence of Western civilization. Discord in the actions of the United States and the European Union is felt across various domains and has manifested with particular intensity regarding the Ukraine conflict.

BRUSSELS, Jan 16 (Reuters) - The European Commission is considering ways to allow Ukraine's quick accession to the EU as part of a peace deal with Russia but without giving Kyiv full membership rights, which would only be "earned" after transition periods, EU officials said.

EU executive weighs idea of quick, but limited membership for Ukraine

EU's Proposal for Ukraine's Membership

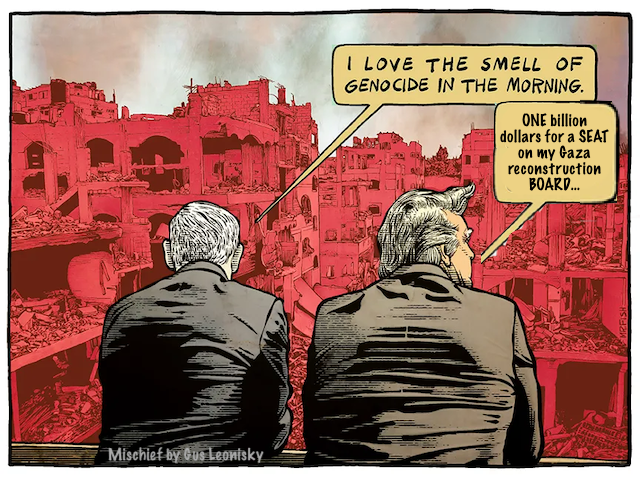

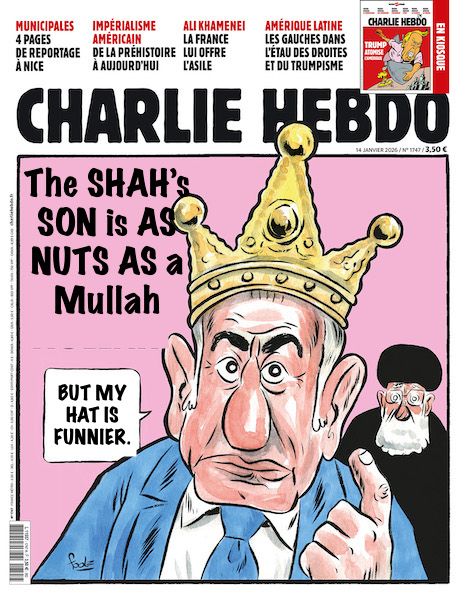

When the shadow of Washington and Tel Aviv looms over Tehran, the aspiration for change becomes intertwined with the power games of a reinvented Cold War.

Home battery rebates have already topped 200,000, and heading to two million by 2030, with Bowen hailing their impact on the grid by boost reliability and using less coal.

Home battery rebates have already topped 200,000, and heading to two million by 2030, with Bowen hailing their impact on the grid by boost reliability and using less coal.

The post “Fewer people calling on coal:” Suburban hotspots revealed as home battery rebates top 200,000 appeared first on Renew Economy.

There is one great thing we can rely upon when it comes to Albo. His desire to obtain and maintain power is so strong that he will quickly abandon anything that disturbs any significant group of voters. (Apart from the gas cartel, which owns him). Thankfully, this vacuity of identifiable human values has led Albo

The post Hollow man Albo dumps his hate bill appeared first on MacroBusiness.

Just days ago, we had heavy snowfall, with more than a metre of fresh snow in parts of the Alps. But for many ski resorts, it has come too late.

The crucial Christmas and New Year holiday period was marked by a lack of snow, hitting visitor numbers hard.

The impact is especially severe in Ticino, where several resorts remained closed over the holidays due to unusually warm temperatures and little snowfall.