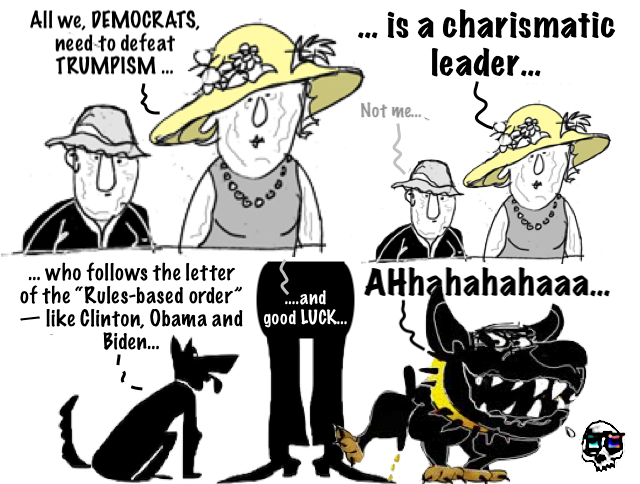

In the face of Trump and his triumphant ethnonationalism, the regulatory parties – whether it be on artificial intelligence, environmental policy, financial capitalism or international relations – are remaining silent for now, notes Le Monde columnist Gilles Paris.

'The Democratic Party is waiting for Trump's departure, praying his successors fail to revive Trumpism'

Ukraine must create conditions that encourage its young men to remain in the country rather than flee to Western Europe, German Chancellor Friedrich Merz has said.

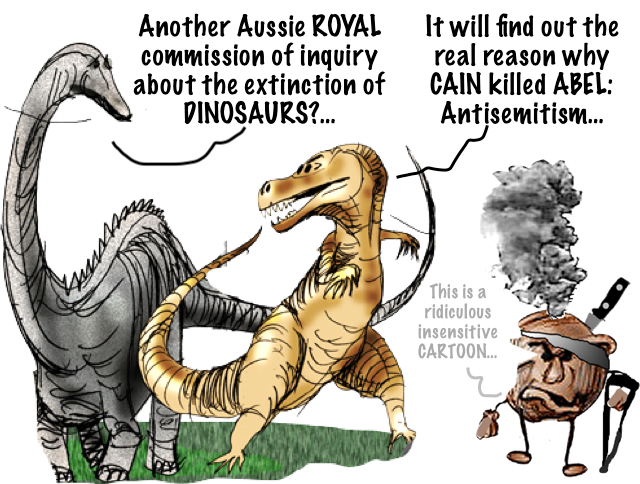

Calls for a royal commission after the Bondi shootings reflect public anger and distrust, but decades of experience suggest such inquiries rarely deliver lasting reform or accountability.

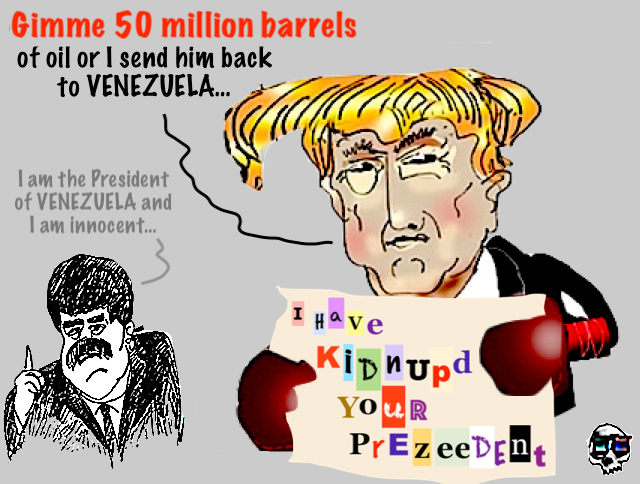

The Russian Transport Ministry has confirmed that the oil tanker ‘Marinera’ has been captured by the US military.

Earlier on Wednesday, the US European Command announced having taken possession of the ship, previously named the ‘Bella 1’, for alleged “violation of US sanctions.”

If the Palestine Action hunger strikers die, the government will be responsible.

By George Monbiot, published in the Guardian 7th January 2026

Australian property has benefited from numerous support mechanisms and government interventions to bolster its fortunes in the years since the pandemic began. $188 billion in funding from the RBA to the banks at just 0.1% interest, facilitating the rise of 3-year fixed-rate mortgages at under 2%. This led to 40% of all Australian mortgages being

Asian share markets are not doing well despite a strong lead from Wall Street overnight with commodity volatility one of the culprits as oil prices move lower as silver explodes higher. Currency markets are seeing a little bit of stability with USD losing some ground against Yen but outperforming Euro and Loonie. The November inflation

The post Macro Afternoon appeared first on MacroBusiness.

An American madman is loose. At a press conference on his plane as he returned to Washington for a new political year he entertained the idea of targeting another four nations. He started with Colombia, which he said had a leader who “likes making cocaine” but is “not going to be doing it very long”.

The post An American madman crashes the world order appeared first on MacroBusiness.

Everybody wants a royal commission into anti-Semitism, apparently. With the government’s reasons for opposing a royal commission being widely panned and the inquiry being backed by leading figures in the business, sporting, legal and security sectors, the issue was scheduled to be debated earlier this week at a meeting of the national security committee of

With the release of the latest ABS Building Approvals data, it was revealed that non-detached house approvals had risen to their highest level since June 2018, up by 34.1% month on month and 55.3% year on year to 8,463 for the month of November. Meanwhile, approvals for detached houses were up by 1.3% for the

The post Apartment approvals boom to 7 year high appeared first on MacroBusiness.

When in late November the ABS delivered it’s first complete monthly inflation print, it immediately triggered a dramatic repricing in interest rates and economists predictions for future inflation. When the AFR polled 38 economists for their views on where interest rates were heading prior to today’s monthly inflation print, 17 out of 38 predicted that

Is a widening commodities bid suggesting reflation? Or a bubble? OR something else? The Market Ear. No inflation… ….unless you need commodities. Are we in the early stages of reflation? As Goldman’s Privorotsky writes: “…either points to a broad dollar devaluation or a rapid re-acceleration in the global economy.” Chart 1 shows BCOM vs US

The post Enter the commodoties bubble? appeared first on MacroBusiness.

The Albanese government’s $10 billion Housing Australia Future Fund (HAFF) was launched in late 2023 and aims to deliver 40,000 social and affordable homes by 2028. The HAFF operates as a perpetual fund managed by the Future Fund Management Agency. It provides an ongoing funding stream of at least $500 million per year, indexed to

The post Another Labor housing policy failure appeared first on MacroBusiness.