The fourth wind farm to reach financial close in a late 2025 flurry of activity will feature the most powerful turbines to be installed in Australia to date.

The fourth wind farm to reach financial close in a late 2025 flurry of activity will feature the most powerful turbines to be installed in Australia to date.

The post Australia’s most powerful turbines unveiled as fourth wind farm reaches financial close in Xmas flurry appeared first on Renew Economy.

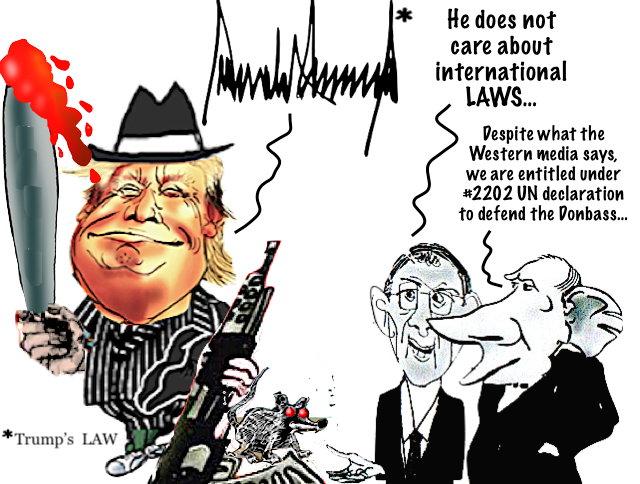

The US military intervention in Venezuela to kidnap President Maduro was a gross violation of the UN Charter. Nothing justifies this blatant flouting of international law. The arguments given by the US to justify its aggression do not stand up to scrutiny.

New CEO for Endeavour Energy, plus people movements at GridCog.

New CEO for Endeavour Energy, plus people movements at GridCog.

The post Grid Connections 2026: Who’s going where and doing what in Australia’s green energy transition appeared first on Renew Economy.

"Among the men who have profoundly affected the development of mankind and have given their best energies to the promotion of toleration, reason, and justice, Voltaire stands without a peer. Gifted as he so evidently was by nature for intellectual leadership and literary supremacy in France and in Europe, he was never content with these honors alone.

Donald Trump’s anarcho-imperialism has given DXY a new leg as snowflake EUR melts in the new world order. AUD is at critical support. CNY is still supportive. Gold is unstoppable. Oil trying again. Metals did better, but DXY up means they are going down. EM too. Junk rejection. US curve keeps steepening. Stocks liked weak

The post Australian dollar rally frozen in Greenland appeared first on MacroBusiness.

Dancing, dancing, dancing! There is no stopping the iron-ore-crazy man. Except for one small problem. Steel mill margins are being obliterated. These developments will weaken the start of 2026 steel production, especially because steel product inventories are higher than last year. And there is another problem. The iron-ore-crazy man is dancing on top of the

Robber Fly with catch Photo courtesy of Geoff McVeigh Reads (more coming) Why is Trump interested in Greenland? Look to the thawing Arctic ice – The Guardian Here’s why Labour is struggling to deliver: the British state is immense, but pull the levers and nothing happens – The Guardian The Bondi

The post Weekend links and Videos: 10 – 11 January 2026 appeared first on MacroBusiness.

Je vois des peuples infortunés gémissants sous un joug de fer, le genre humain écrasé par une poignée d’oppresseurs, une foule affamée, accablée de peine et de faim, dont le riche boit en paix le sang et les larmes, et partout le fort armé contre le faible du redoutable pouvoir des lois...

Jean-Jacques Rousseau

Former US Secretary of State and CIA Director Mike Pompeo seems irked that the Ukraine conflict could end without Russia groveling and handing over concessions on a silver platter.

The Australian government remains silent on Israel banning 37 international aid organisations in Gaza, despite warnings from humanitarian groups. Stephanie Tran reports.

Asian share markets are generally higher in the final session of the week however are hedging what will come later tonight with the expected US Supreme Court ruling on the Trump regime’s tariffs and the post-government shutdown employment print – aka the NFP. News that Trump wants to make his own QE by purchasing $200

The post Macro Afternoon appeared first on MacroBusiness.

The Aussie trade balance for November was out yesterday and shows one great, big trend: a disappearing trade surplus. Some of this was always going to happen as the post-Ukraine War commodities mania subsided. I expect we’ll be running a deficit by year’s end as iron ore and energy continue to fall, despite gold. There

The post Albo reloads China’s trade cannon appeared first on MacroBusiness.

Calculated Risk sums the data. On Friday at 8:30 AM ET, the BLS will release the employment report for December. The consensus is for 55,000 jobs added, and for the unemployment rate to decrease to 4.5%. There were 64,000 jobs added in November, and the unemployment rate was at 4.6%. From Goldman Sachs: We forecast that

The post US jobs preview appeared first on MacroBusiness.

Charts from TME. SPX is caught in a bearish rising wedge, tough it could also be seen as a bullsh asending triangle. Tech is more neutral and could go either way from a symmetrical triangle. The NY rotation has been from tech to the broader market, or, put another way, from AI spenders to AI

The post Tech bubble struggles to find oxygen appeared first on MacroBusiness.

As of the latest building approvals data from the ABS, in the last 12 months, 111,500 detached houses were approved for construction. This result comes with both good news and bad news. The good news is that the figure for detached house approvals is up by 6,800 homes from the lows seen in December 2023.

The post House approvals plunge back to 1970s levels appeared first on MacroBusiness.