The news first. Andrew Hastie has been given the blessing of his young family to enter the Liberal leadership race, as conservative powerbrokers lean towards backing the 43-year-old to replace Sussan Ley. Just hours after likely leadership rival Angus Taylor returned from overseas, sources close to Mr Hastie confirmed that the West Australian MP had discussed

From the marvellous Michael Hartnett at BofA. Zeitgeist: “When the market goes up, they should lower rates” Trump on the Fed. Zeitgeist: “Only three certainties are death, taxes, and new highs in Japanese banks.” Tale of the Tape: Japan yen weakest vs. China renminbi since 1992 (Chart 6); biggest risk to max bull Q1 consensus

The post Of stocks and the madman appeared first on MacroBusiness.

New Zealand experienced one of the biggest house price booms in the world during the pandemic. However, since prices peaked in late 2021, values in real inflation-adjusted terms have plummeted by more than 30% to levels last seen in 2019, nearly six years ago. The latest house price results from the REINZ showed that home

Now, this is a tricky one, George, because it’s a subject on which my opinion has altered violently. And this is a disaster! My God, everyone knows that newspaper readers cling to the opinions of columnists like passengers on the Titanic fastened on to the few lifeboats there upon the chopping, churning sea.

Last year, I claimed that the Australian Treasury’s modelling of Labor’s 5% deposit scheme for first home buyers demonstrated that the Treasury had become the federal government’s propaganda arm. Labor’s First Home Buyer Guarantee program, which went into effect in October 2025, allows nearly all first home buyers to purchase a property with only a

The Great Chinese Depression is in full swing. Property sales are catastrophic in the new year. The secondary market looks like a run for the exits. As prices fall relentlessly. Energy consumption is better but only due to the weather. China is at peak oil. Fiscal is booming. But building is going backwards. The boom

The post The Great Chinese Depression deepens appeared first on MacroBusiness.

Envision’s Chifeng project has been recognised by the World Economic Forum as a leading global green hydrogen model.

Envision’s Chifeng project has been recognised by the World Economic Forum as a leading global green hydrogen model.

The post Envision’s AI-powered green ammonia and hydrogen breakthrough recognised by World Economic Forum appeared first on Renew Economy.

The ferrous jaws have to close. Sorry! Steel data is mixed. Mysteel demand is up, but only because CNY is three weeks later this year. MySteel production data is dead flat. But, again, arguably down YOY seasonally adjusted. WorldSteel ended the year with a whimper. World crude steel production for the 70 countries reporting to

The post China’s 30 great pyramids of iron ore appeared first on MacroBusiness.

No matter how hard you try. No matter how many facts you put in its way. The fake left will never acknowledge the terrible truth. It was they who abandoned class politics for culture wars and created the populist right in the process. It’s not rocket surgery, but central to fake left ideology is the

The post Karen Middleton is Pauline Hanson’s best friend appeared first on MacroBusiness.

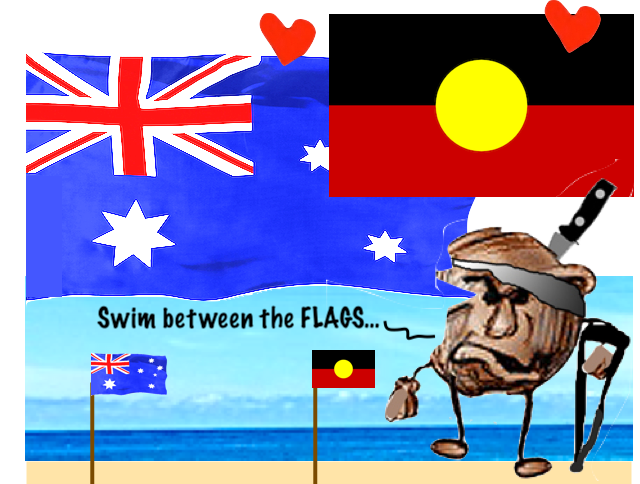

For as long as I can remember, the date of Australia Day has been a source of controversy, with ‘Invasion Day’ protests taking place year after year. But recent polling from Resolve suggests that public opinion has shifted significantly toward the date remaining on the 26th of January. According to Resolve, 68% of Australian voters

The post Is the Australia Day battle over? appeared first on MacroBusiness.

Australia’s alliance with the United States is no longer reliable, and clinging to it now risks Australia’s interests and values. The case for a deliberate, staged Plan B begins with strategic autonomy – and an overdue reckoning with extended nuclear deterrence.

Right-wing campaign groups and Coalition MPs are again using Australia Day to drive petitions, wedge politics and anti-elite rhetoric. This year’s campaign is being amplified by paid digital ads, ARC grant outrage and calls to “legislate the date”.

Washington and Kiev have discussed several options for ending the Ukraine conflict, including the creation of a demilitarized zone or the deployment of neutral peacekeepers to the Kiev-controlled parts of Russia’s Donetsk People’s Republic (DPR), The New York Times has said. The options were reportedly brought up earlier this week at trilateral talks in the United Arab Emirates (UAE) with Russian officials.