The state of Victoria already has the highest debt load and the nation’s poorest credit rating. Victorians also pay the highest taxes in the nation. The Allan Government last week unveiled a suite of new ‘value capture’ taxes and levies on developers, landowners, and car‑park operators to help fund the Suburban Rail Loop East (SRL

In the long history of financial markets, there have been all manner of hot assets; in the Netherlands in the 1630s, it was tulip bulbs, in the 1720s Britain, it was shares in the South Sea Company, and today the hottest asset on the market is anything to do with AI. In the United States,

The post Macquarie rings the bell on data centres appeared first on MacroBusiness.

In the early 2010s, the federal Labor government made the ill-fated decision to allow liquefied natural gas (LNG) exports from Queensland without requiring gas companies to first supply Australians. Gary Grey, the then-Federal Resources Minister under the Gillard/Rudd Labor governments, claimed that domestic gas reservation would cause uncertainty and discourage investment, placing the government against

Wall Street and other risk markets are drifting into holiday mode which means not a lot of selling and small gains here and there although silver and gold are making record highs while the USD is getting sold down the river. Defense stocks helped Wall Street overnight while Yen stabilised somewhat after a big move

The post Macro Morning appeared first on MacroBusiness.

Justin Fabo from Antipodean Macro posted the following chart showing that Australians are paying some of the highest mortgage rates in the developed world. Following three 25 bp rate cuts from the Reserve Bank of Australia (RBA), the weighted-average interest rate on outstanding housing loans in Australia has declined by 69 bps from the peak

From the Market Ear: Waiting SPX remains stuck inside the range that has been in place since mid-September. We aren’t getting too excited until we break out, either way. Also stuck NASDAQ continues trading the boring range that has been in place for months. Short term range support: 25000, resistance 26000. Big range support: 24000,

Alex Joiner from IFM Investors published the following chart on Twitter (X) last week, showing the explosive growth in Australia’s net overseas migration (NOM), particularly since the end of the Covid-19 pandemic. Joiner noted that as of Q4 2000, it had taken 12 years of NOM to add 1,000,000 people to the population. As of

The world's biggest battery energy storage system – a 7.8 gigawatt-hour behemoth – has been completed in Saudi Arabia, and will now start the process of powering up.

The world's biggest battery energy storage system – a 7.8 gigawatt-hour behemoth – has been completed in Saudi Arabia, and will now start the process of powering up.

The post World’s largest grid battery has been completed – in the oil capital of the world appeared first on Renew Economy.

The absolute madness of the proposed new food rules.

By George Monbiot, published in the Guardian 20th December 2025

Most of what you eat is sausages. I mean, if we’re going to get literal about it. Sausage derives from the Latin salsicus, which means “seasoned with salt”. You might think of a sausage as a simple thing, but on this reading it is everything and nothing, a Borgesian meta-concept that retreats as you approach it.

A sea of green across Asian share markets as we head into the low volume Christmas period with a solid finish on Wall Street on Friday night flowing through to the regions risk markets overall. The Australian dollar is bouncing back on a slightly weaker USD with a breakout above the 66 cent level. Oil

The post Macro Afternoon appeared first on MacroBusiness.

The first of what may be quite a few articles I reproduce here which I wrote for The Mandarin from around 2016 to 2020 or thereabouts (The Mandarin has put the articles I wrote for them behind its paywall so … Continue reading →

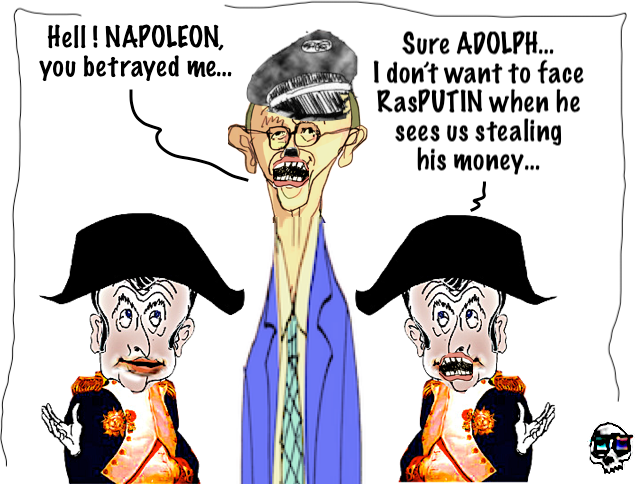

French President Emmanuel Macron “betrayed” Friedrich Merz by failing to back the German chancellor’s push to steal Russian assets frozen in the EU to fund Ukraine, the Financial Times has claimed.

Earlier this week, EU leaders failed to agree on the European Commission’s controversial proposal to use Russia's immobilized central bank funds to finance Kiev’s military and economy.

Why did it happen? I think that the combination of four factors (listed below) was close to a sufficient cause. Sufficient at least to make a terrorist attack highly likely. And they are also arguably necessary. I think if you … Continue reading →