Australian offshore wind start-up that blazed a trail for the nascent technology will wind up its operations in 2026. Warns Australia needs to "up its game."

Australian offshore wind start-up that blazed a trail for the nascent technology will wind up its operations in 2026. Warns Australia needs to "up its game."

The post Australian offshore wind trailblazer pulls up stumps, warns against “overstated risk aversion and timidity” appeared first on Renew Economy.

Below is an excellent satire post from MB reader Erin Rolandsen, CEO of Angelassist and author of beyondtheragemachine.substack.com: With Christmas approaching, many parents are once again facing the annual dilemma: What gift best prepares my child for the world they are inheriting? Toys that encourage imagination? Books that inspire curiosity? Or perhaps something more realistic. This year, why

In a week that could have seen Australia united through tragedy, mainstream media, politicians and many others have taken the opportunity to sow division instead. Even the pollsters.

One of Australia's biggest proposed pumped hydro projects has been given a federal green tick to undertake exploratory works in Queensland's Gympie region.

One of Australia's biggest proposed pumped hydro projects has been given a federal green tick to undertake exploratory works in Queensland's Gympie region.

The post Huge Queensland pumped hydro project gets federal green tick to begin stage one works appeared first on Renew Economy.

On Thursday, the Australian Bureau of Statistics (ABS) released official population and immigration data for the June quarter, revealing that annual net overseas migration (NOM) declined to 305,500. The decline in annual NOM came despite the ABS at the same time releasing detailed labour force data for November, showing that working-age (15-plus) population growth has

The world's biggest isolated grid, in Western Australia, is currently the most gas dependent in the country, but this share will decline rapidly even after the exit of coal.

The world's biggest isolated grid, in Western Australia, is currently the most gas dependent in the country, but this share will decline rapidly even after the exit of coal.

The post Gas power faces rapid decline in world’s biggest isolated grid, even after exit of coal, as batteries hold court appeared first on Renew Economy.

Two months ago, the Queensland government signalled a major retreat from net zero, announcing it would extend the life of coal-fired power stations until the mid-2040s and expand gas generation capacity under its new five-year energy roadmap. The move significantly undermined the Albanese government’s ambitious 62% to 70% emissions reduction target by 2035. The five-year

As the horrific details of the Bondi massacre came to light, many Australians have been wondering how this could have happened. How did Naveed Akram, linked to Islamic State (ISIS) since 2019, live in a home with his father, Sajid Akram and his half a dozen registered firearms from 2023 onwards? Based on a study

The post ASIO, Bondi and the far right appeared first on MacroBusiness.

The Suburban Rail Loop (SRL) proposed by the Victorian government was opposed by almost all infrastructure experts due to its high cost, lack of a business case, failure to pass any objective cost-benefit analysis, and inability to generate sufficient customer demand. For instance, the SRL East and North parts have a benefit-cost ratio (BCR) of

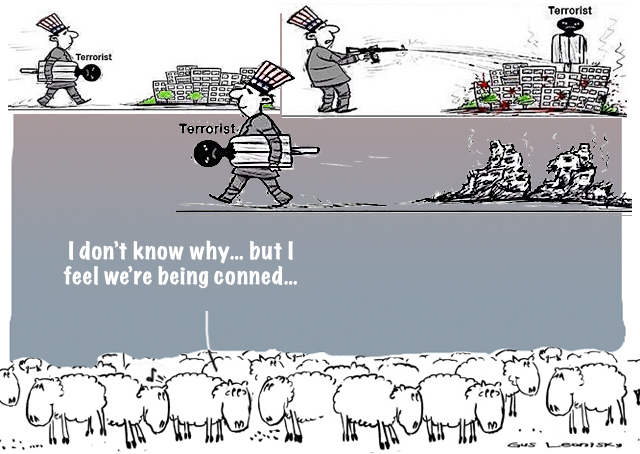

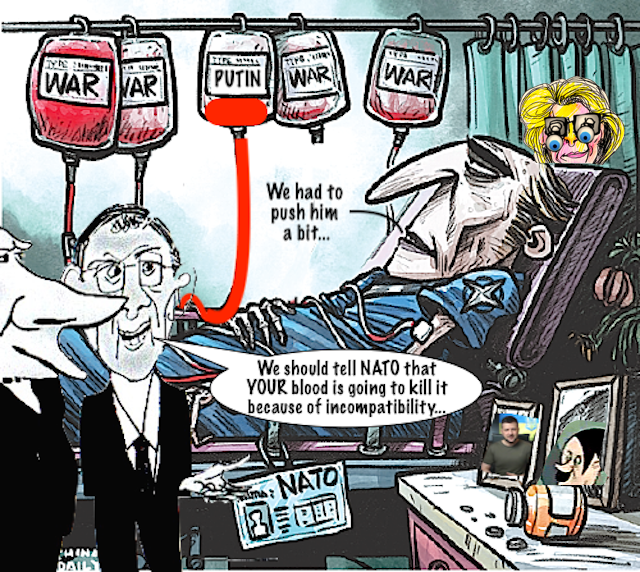

As the negotiations for a diplomatic settlement to end the war in Ukraine gain momentum, European leaders insist on slowing them down by repeating three lies. These are, essentially, the same lies they have been telling since the war began.

A paradoxically unvolatile session overnight as Wall Street bounced back on a surprise downside print in US inflation while the ECB and BOE held fire on interest rate rises all of which barely moved currency markets. Asian share markets should expect a boost in the final full volume trading session before the Xmas break with

The post Macro Morning appeared first on MacroBusiness.

The iron ore price has risen by about 7% so far in 2025, but CBA head of commodities Vivek Dhar warns that oversupply concerns could soon see the price of the steel input fall below $US$100 per tonne. Dhar notes that demand headwinds are accelerating in China, while shipments from the Simandou project in Guinea

The post Bears growl at “cracking” iron ore market appeared first on MacroBusiness.

Market operator turns to country's most powerful battery to guarantee supplies with one third of the NSW coal fleet offline in the middle of a heatwave.

Market operator turns to country's most powerful battery to guarantee supplies with one third of the NSW coal fleet offline in the middle of a heatwave.

The post Australia’s most powerful battery put on standby to prevent blackouts with four big coal units offline appeared first on Renew Economy.

Ausgrid will start building the REZ based around existing infrastructure in early 2026, with work expected to be done within two years.

Ausgrid will start building the REZ based around existing infrastructure in early 2026, with work expected to be done within two years.

The post Construction begins on network upgrade to bring major coal region into the energy future appeared first on Renew Economy.