I love the optimism of Santa Claus

Father Christmas, Père Noël and Saturnalia

I enjoy the commercialism of these times

When boots become full of joy and paraphernalia

Useless toys, new cars with CO2 exhausts

For dumb kids and environmental crimes

I love the shops and their bright windows

full of tinselling love and fake falling snows

By Ashwin Clarke, Senior Economist at CBA: We updated our economic outlook for 2026 this week. We expect GDP growth to pick up a little further over the next 6 months before settling down by end 2026. With growth above capacity, and a resilient consumer, we expect inflation to show signs of persistence and the

The post The economic week ahead appeared first on MacroBusiness.

THE FOLLOWING ARTICLE AT IAI news IS RELATIVELY WRONG AS IT SEEMS TO IGNORE THE NECESSARY PHYSICALITY OF MEMORY…

Revelations about overseas training, intelligence failures and police responses raise urgent questions that cannot be left to internal reviews.

The first large scale solar battery hybrid project to join Australia's main grid has been energised, and is getting ready to feed stored solar into evening peaks.

The first large scale solar battery hybrid project to join Australia's main grid has been energised, and is getting ready to feed stored solar into evening peaks.

The post First solar-battery hybrid on Australia’s main grid is energised, and ready to send PV into evening peaks appeared first on Renew Economy.

A new analysis by the news outlet DeSmog finds that the Trump administration’s efforts at EPA and other agencies to support coal generation, combined with growing energy demand driven by artificial intelligence, are prompting 15 U.S. coal plants to delay planned retirements this year, with one plant delaying its closure by seven years.

The great baseball legend and jokester Yogi Berra once quipped that a restaurant had become so crowded that nobody goes there anymore. Here’s a version for today: young people in America have such dismal economic prospects that they spend more money than ever.

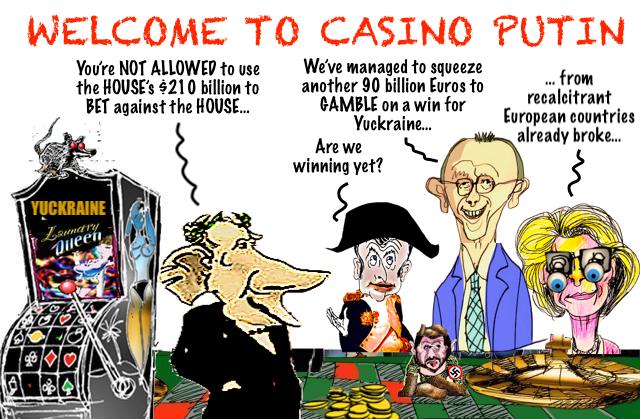

The EU’s determination to further fund Kiev’s military and prop up its imploding economy has been presented as a kind of victory. “Europe has delivered,” German Chancellor Friedrich Merz proclaimed, in celebration of a new cash facility for Kiev.

International Reading: Gen Z would rather cut Social Security benefits for current retirees than pay higher taxes to save the program – Market Watch Trump says tariffs have brought in $18 trillion. That’s impossible – Reason Recession indicator ‘blinking red,’ warns economist – News Week Trump’s tariffs crush small US manufacturers including music gear makers

A better finish for Asian share markets in response to a bounce on Wall Street overnight as a softer than expected CPI print was balanced by more evidence of a softening labour market as the US economy slows down due to the Trump regime’s well – “point at everything”…. The BOJ meeting today resulted in

The post Macro Afternoon appeared first on MacroBusiness.

A hot mid-week day placed Australia’s main grid, the National Electricity Market, under clear operational stress on Thursday, particularly in New South Wales where LOR3 and RERT market notices were issued.

A hot mid-week day placed Australia’s main grid, the National Electricity Market, under clear operational stress on Thursday, particularly in New South Wales where LOR3 and RERT market notices were issued.

France is building one of its biggest batteries on its territory in New Caledonia, where it will help wean the nickel mining island off coal and oil.

France is building one of its biggest batteries on its territory in New Caledonia, where it will help wean the nickel mining island off coal and oil.

The post Huge new battery will be able to power South Pacific island for three hours a day, and pave way for more solar appeared first on Renew Economy.

ABC News reported that Australians are flocking to cheap retailers like Temu, Shein, and Amazon, which combine ultra-cheap products with fast delivery. However, their success is putting pressure on traditional brick‑and‑mortar retailers, which are struggling to compete. In particular, online giants can undercut prices due to lower overheads, making it difficult for smaller shops to