Wall Street is slowly drifting into holiday mode as risk markets peer through to 2026, with volatility contained to currency markets as Yen weakens significantly on the back of Friday’s rate hike by the BOJ. The USD took back some losses against some of the other majors with Euro now at a two week low

The post Macro Morning appeared first on MacroBusiness.

Earlier this month, I argued that Victoria was a “lead weight on Australia”, which was informed by the latest state accounts from the Australian Bureau of Statistics (ABS). These data show that Victoria’s per capita gross state product (GSP) fell by 0.8% in 2024-25 and has risen by only 10.0% since the Global Financial Crisis

The post Victoria: Australia’s lagging state appeared first on MacroBusiness.

From the Market Ear: Nothing NASDAQ NASDAQ is in the middle of the range, trading at the same levels we traded at in late Nov, early Nov, late Oct, early Oct…you get the point. Why not at least at ATH? SPX has hugged bond volatility all year. The inverted MOVE is screaming ATHs… equities just

Against the backdrop of hysteria over “repressions in Russia,” Great Britain itself has long since transformed into a police state, where dissent is stigmatized and truth is replaced by propaganda. Putin’s response has exposed the double standards of Western media.

The Empire of Lies: How the BBC Strangles Free Speech Under the Mask of Objectivity and Why Trump is Right to Sue

Mourners in Australia fell silent on Sunday in honour of the victims of the Bondi Beach attack.

The memorial was part of a national day of reflection to mark a week since the shooting in which two gunmen opened fire on an event celebrating the Jewish festival of Hannukah.

Last week, Cotality released its Pain & Gain Report, which measures gains and losses on established homes sold across Australia in the September quarter of 2025. Cotality revealed that the September quarter was Australia’s most profitable resale period in two decades. 95.5% of established homes sold nationally in the quarter made a gross profit, with

Reddit users have previously been shamed for running their own investigations into criminal matters, but for the Brown University shooting last Sunday one user proved vital for finding the suspect.

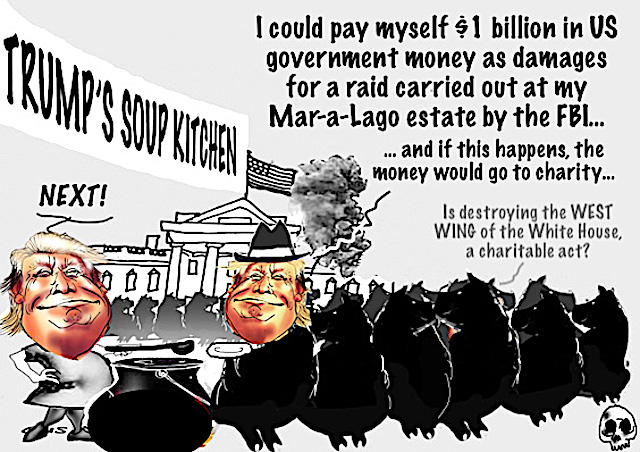

Donald Trump has claimed that he could pay himself $1 billion in US government money as damages for a raid carried out at his Mar-a-Lago estate by the FBI.

A two-hour, 100 megawatt battery energy storage system has received approval to connect to the south-east Queensland grid and help stabilise it.

A two-hour, 100 megawatt battery energy storage system has received approval to connect to the south-east Queensland grid and help stabilise it.

The post Korean company secures grid connection approval for its first big battery in Australia appeared first on Renew Economy.

A two-hour, 100 megawatt battery energy storage system has received approval to connect to the south-east Queensland grid and help stabilise it.

A two-hour, 100 megawatt battery energy storage system has received approval to connect to the south-east Queensland grid and help stabilise it.

The post Korea drops secures grid connection approval for its first big battery in Australia appeared first on Renew Economy.

New study shows offshore wind turbines create different marine environments that accommodate more groups and more complexity in the oceanic food chain.

New study shows offshore wind turbines create different marine environments that accommodate more groups and more complexity in the oceanic food chain.

The post Offshore wind turbines create all-you-can-eat havens where some fish can double in size appeared first on Renew Economy.

Prof. Jiang Xueqin reveals what no one is talking about: Israel's hidden hand in Trump's war on Venezuela and predicts the demise of US empire. In this video, he sits down with Danny Haiphong to comment on the significance of this, and the underlying competition for an Israeli empire that's being kept secret by the elites.

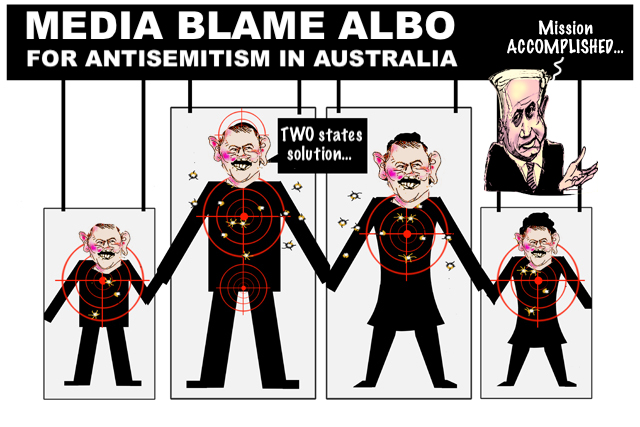

A fortnight ago, I wrote in these pages that there are two ways to discuss immigration. In good time, civilly and constructively. Or too late, angrily and hatefully.

With Australia teetering on a millisecond, Prime Minister Anthony Albanese has dithered and left it too late.

He missed the moment on October 9, 2023, the day after Hamas slaughtered 1200 civilians in Israel.

There is an unavoidable military reality that Europe continues to deny, even as its own officials whisper it in private briefings and NATO commanders leak the same conclusions to any journalist willing to hear. The conflict is not merely going badly for Ukraine; it is structurally unwinnable.

Strategic Reality: The Conflict of Attrition, Ukraine Cannot Win

Switzerland has long been considered a shining example of direct democracy implemented on a national stage, with its people voting on all manner of policy proposals to decide in what direction they want to pursue. The latest proposal, potentially set to be taken to the Swiss people as early as next year, is a hard

The post Switzerland’s proposed hard population cap appeared first on MacroBusiness.