|

Your Democracy

Saturday, December 20, 2025 - 09:03

Source

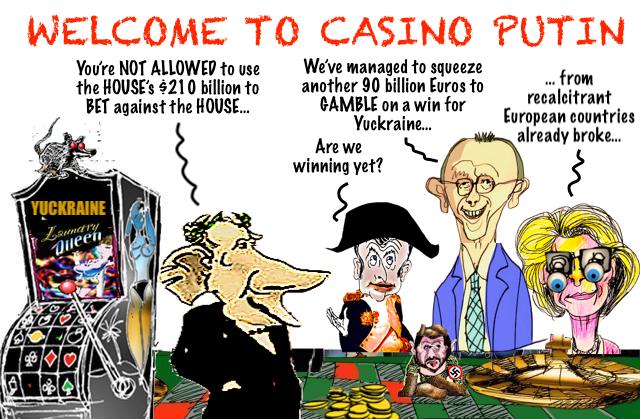

The EU’s determination to further fund Kiev’s military and prop up its imploding economy has been presented as a kind of victory. “Europe has delivered,” German Chancellor Friedrich Merz proclaimed, in celebration of a new cash facility for Kiev.

|

MacroBusiness

Saturday, December 20, 2025 - 00:05

Source

International Reading: Gen Z would rather cut Social Security benefits for current retirees than pay higher taxes to save the program – Market Watch Trump says tariffs have brought in $18 trillion. That’s impossible – Reason Recession indicator ‘blinking red,’ warns economist – News Week Trump’s tariffs crush small US manufacturers including music gear makers The post Weekend reading and MB media appearances appeared first on MacroBusiness. |

|

MacroBusiness

Friday, December 19, 2025 - 16:30

Source

A better finish for Asian share markets in response to a bounce on Wall Street overnight as a softer than expected CPI print was balanced by more evidence of a softening labour market as the US economy slows down due to the Trump regime’s well – “point at everything”…. The BOJ meeting today resulted in The post Macro Afternoon appeared first on MacroBusiness. |

Your Democracy

Friday, December 19, 2025 - 14:56

Source

|

|

Renew Economy

Friday, December 19, 2025 - 13:33

Source

|

Renew Economy

Friday, December 19, 2025 - 13:07

Source

The post Huge new battery will be able to power South Pacific island for three hours a day, and pave way for more solar appeared first on Renew Economy. |

|

MacroBusiness

Friday, December 19, 2025 - 13:00

Source

ABC News reported that Australians are flocking to cheap retailers like Temu, Shein, and Amazon, which combine ultra-cheap products with fast delivery. However, their success is putting pressure on traditional brick‑and‑mortar retailers, which are struggling to compete. In particular, online giants can undercut prices due to lower overheads, making it difficult for smaller shops to |

Renew Economy

Friday, December 19, 2025 - 12:38

Source

The post Australian offshore wind trailblazer pulls up stumps, warns against “overstated risk aversion and timidity” appeared first on Renew Economy. |

|

MacroBusiness

Friday, December 19, 2025 - 12:00

Source

Below is an excellent satire post from MB reader Erin Rolandsen, CEO of Angelassist and author of beyondtheragemachine.substack.com: With Christmas approaching, many parents are once again facing the annual dilemma: What gift best prepares my child for the world they are inheriting? Toys that encourage imagination? Books that inspire curiosity? Or perhaps something more realistic. This year, why |

Your Democracy

Friday, December 19, 2025 - 11:51

Source

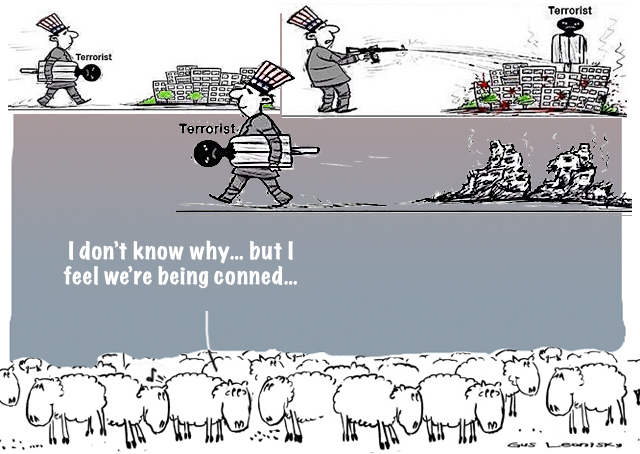

In a week that could have seen Australia united through tragedy, mainstream media, politicians and many others have taken the opportunity to sow division instead. Even the pollsters. Roy Morgan is Australia’s oldest and best-known market research company, “with an unparalleled reputation for reliable, accurate, meaningful, revealing market research,” according to their own blurb. This week, they saw fit to survey people about who was the worst terrorist.

|

|

Renew Economy

Friday, December 19, 2025 - 11:34

Source

The post Huge Queensland pumped hydro project gets federal green tick to begin stage one works appeared first on Renew Economy. |

MacroBusiness

Friday, December 19, 2025 - 11:30

Source

On Thursday, the Australian Bureau of Statistics (ABS) released official population and immigration data for the June quarter, revealing that annual net overseas migration (NOM) declined to 305,500. The decline in annual NOM came despite the ABS at the same time releasing detailed labour force data for November, showing that working-age (15-plus) population growth has |

|

Renew Economy

Friday, December 19, 2025 - 11:26

Source

The post Gas power faces rapid decline in world’s biggest isolated grid, even after exit of coal, as batteries hold court appeared first on Renew Economy. |

MacroBusiness

Friday, December 19, 2025 - 11:00

Source

Two months ago, the Queensland government signalled a major retreat from net zero, announcing it would extend the life of coal-fired power stations until the mid-2040s and expand gas generation capacity under its new five-year energy roadmap. The move significantly undermined the Albanese government’s ambitious 62% to 70% emissions reduction target by 2035. The five-year |

|

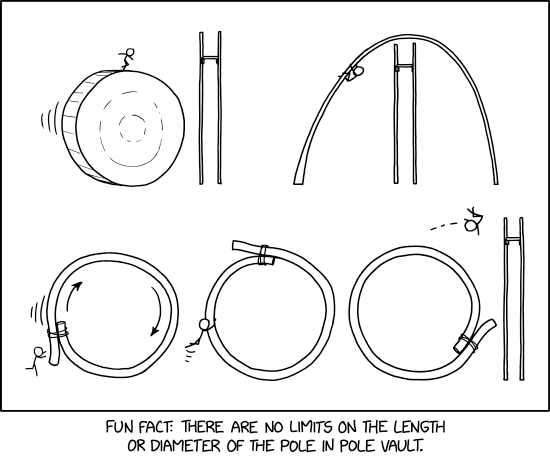

xkcd.com

Friday, December 19, 2025 - 11:00

Source

|

MacroBusiness

Friday, December 19, 2025 - 10:30

Source

As the horrific details of the Bondi massacre came to light, many Australians have been wondering how this could have happened. How did Naveed Akram, linked to Islamic State (ISIS) since 2019, live in a home with his father, Sajid Akram and his half a dozen registered firearms from 2023 onwards? Based on a study The post ASIO, Bondi and the far right appeared first on MacroBusiness. |

|

MacroBusiness

Friday, December 19, 2025 - 10:00

Source

The Suburban Rail Loop (SRL) proposed by the Victorian government was opposed by almost all infrastructure experts due to its high cost, lack of a business case, failure to pass any objective cost-benefit analysis, and inability to generate sufficient customer demand. For instance, the SRL East and North parts have a benefit-cost ratio (BCR) of The post Feds bailout Victoria’s SRL train to nowhere appeared first on MacroBusiness. |

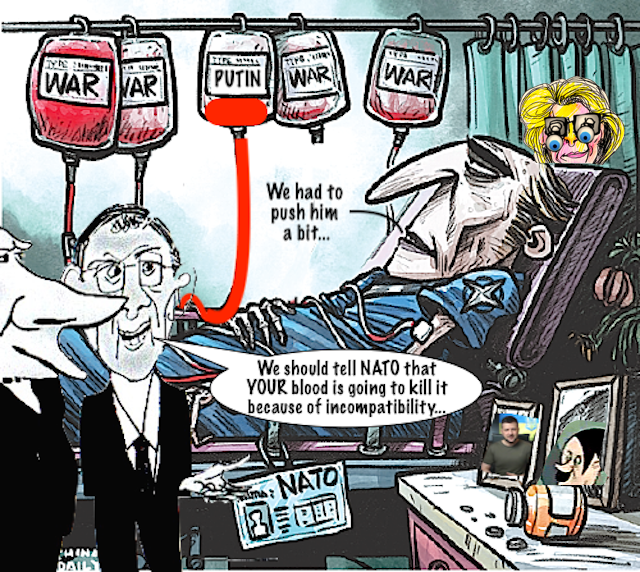

Your Democracy

Friday, December 19, 2025 - 09:21

Source

As the negotiations for a diplomatic settlement to end the war in Ukraine gain momentum, European leaders insist on slowing them down by repeating three lies. These are, essentially, the same lies they have been telling since the war began.

Europe’s Three Lies About UkraineThe European bloc’s reasons to keep the war grinding are unsound at best. |

|

MacroBusiness

Friday, December 19, 2025 - 09:00

Source

A paradoxically unvolatile session overnight as Wall Street bounced back on a surprise downside print in US inflation while the ECB and BOE held fire on interest rate rises all of which barely moved currency markets. Asian share markets should expect a boost in the final full volume trading session before the Xmas break with The post Macro Morning appeared first on MacroBusiness. |

MacroBusiness

Friday, December 19, 2025 - 08:00

Source

The iron ore price has risen by about 7% so far in 2025, but CBA head of commodities Vivek Dhar warns that oversupply concerns could soon see the price of the steel input fall below $US$100 per tonne. Dhar notes that demand headwinds are accelerating in China, while shipments from the Simandou project in Guinea The post Bears growl at “cracking” iron ore market appeared first on MacroBusiness. |

|

Renew Economy

Friday, December 19, 2025 - 07:51

Source

The post Australia’s most powerful battery put on standby to prevent blackouts with four big coal units offline appeared first on Renew Economy. |

Renew Economy

Friday, December 19, 2025 - 07:11

Source

The post Construction begins on network upgrade to bring major coal region into the energy future appeared first on Renew Economy. |

|

MacroBusiness

Friday, December 19, 2025 - 07:00

Source

From the Market Ear: SOX – from sexy to soggy Over the weekend we flagged the risk of a massive SOX double top. Today, that risk is starting to materialise. SOX is slicing through the 50-day and slamming into its longer-term trend line. Lose this level and the downside gets ugly fast, with the 200-day The post Semiconductor index breaks at worst possible time appeared first on MacroBusiness. |

Your Democracy

Friday, December 19, 2025 - 05:44

Source

A Jewish woman wearing a Keffiyeh as well as the Star of David was escorted off Bondi Beach by police. The resulting social media storm led to death threats to her and to her friend. I am writing this knowing it will likely result in more death threats. That is not a metaphor. It is a statement of fact, based on what happened to my friend Michelle and me this week, and what happened next when we sought protection from the state. |

|

Digitopoly

Friday, December 19, 2025 - 02:14

Source

It is time to look back at digital technology in 2025 and make light of it. This review will be arranged much like the Oscars, with awards in various categories. Just as in past years, there are three criteria for the dozen awards this year:• The award must involve digital technology, such as viral videos or crazy communications technologies• The key event must have taken place this year, 2025.• The award cannot take itself seriously. The event receiving attention must lend itself to sass, sarcasm, and ridicule. |

MacroBusiness

Friday, December 19, 2025 - 00:05

Source

China (31.8% share in 2024) and India (8.3% share in 2024) have driven the increase in global carbon emissions this century. Both nations have shown an insatiable appetite for coal. In 2024, China accounted for 55.8% of the world’s coal consumption, whereas India accounted for 13.9%. Australia, by contrast, accounted for only 0.9% of the The post China and India drive record global coal consumption appeared first on MacroBusiness. |

|

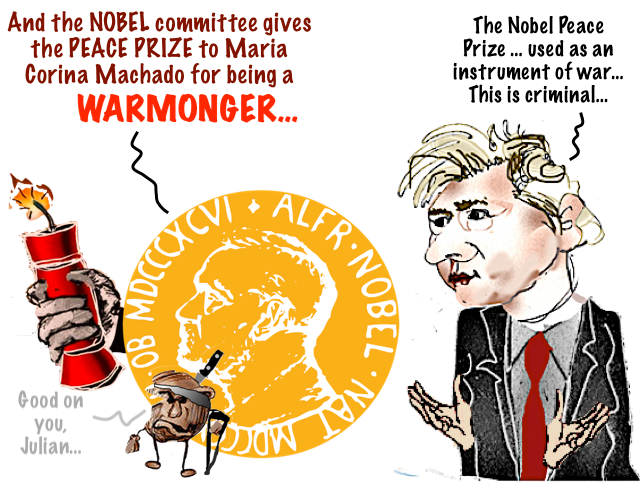

Your Democracy

Thursday, December 18, 2025 - 21:51

Source

WikiLeaks co-founder Julian Assange has filed a criminal complaint against the Nobel Foundation, accusing it of misusing Nobel Peace Prize funds by awarding them to Venezuelan opposition figure Maria Corina Machado, who has publicly called on the US to attack her own country. |

Renew Economy

Thursday, December 18, 2025 - 17:30

Source

The post Renewable certificate prices “drop like a stone” and are headed even lower as corporate demand dries up appeared first on Renew Economy. |

|

Renew Economy

Thursday, December 18, 2025 - 16:28

Source

The post Second wind farm in two days reaches financial close, first on main grid for 2025 appeared first on Renew Economy. |

Your Democracy

Thursday, December 18, 2025 - 15:02

Source

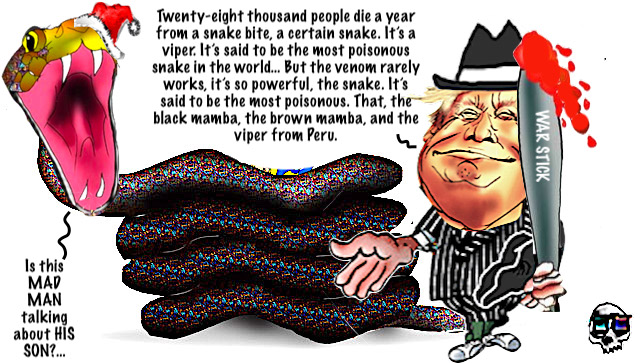

Guests at the White House Christmas reception fell silent Sunday as President Donald Trump veered way off topic to deliver a cozy holiday tale about … poisonous snakes? |

A hot mid-week day placed Australia’s main grid, the National Electricity Market, under clear operational stress on Thursday, particularly in New South Wales where LOR3 and RERT market notices were issued. At the same time, near-record demand created an important window into how much renewable capacity is available across the system when load is high […]

A hot mid-week day placed Australia’s main grid, the National Electricity Market, under clear operational stress on Thursday, particularly in New South Wales where LOR3 and RERT market notices were issued. At the same time, near-record demand created an important window into how much renewable capacity is available across the system when load is high […] France is building one of its biggest batteries on its territory in New Caledonia, where it will help wean the nickel mining island off coal and oil.

France is building one of its biggest batteries on its territory in New Caledonia, where it will help wean the nickel mining island off coal and oil. Australian offshore wind start-up that blazed a trail for the nascent technology will wind up its operations in 2026. Warns Australia needs to "up its game."

Australian offshore wind start-up that blazed a trail for the nascent technology will wind up its operations in 2026. Warns Australia needs to "up its game."

One of Australia's biggest proposed pumped hydro projects has been given a federal green tick to undertake exploratory works in Queensland's Gympie region.

One of Australia's biggest proposed pumped hydro projects has been given a federal green tick to undertake exploratory works in Queensland's Gympie region. The world's biggest isolated grid, in Western Australia, is currently the most gas dependent in the country, but this share will decline rapidly even after the exit of coal.

The world's biggest isolated grid, in Western Australia, is currently the most gas dependent in the country, but this share will decline rapidly even after the exit of coal.

Market operator turns to country's most powerful battery to guarantee supplies with one third of the NSW coal fleet offline in the middle of a heatwave.

Market operator turns to country's most powerful battery to guarantee supplies with one third of the NSW coal fleet offline in the middle of a heatwave. Ausgrid will start building the REZ based around existing infrastructure in early 2026, with work expected to be done within two years.

Ausgrid will start building the REZ based around existing infrastructure in early 2026, with work expected to be done within two years.

Renewable energy certificate prices - the currency that has underpinned of wind and solar in Australia - have plunged to record lows and could halve again.

Renewable energy certificate prices - the currency that has underpinned of wind and solar in Australia - have plunged to record lows and could halve again. Wind finance drought turns into a minor flood, with the second wind project reaching financial close in two days, and the first on Australia's main grid in 2025.

Wind finance drought turns into a minor flood, with the second wind project reaching financial close in two days, and the first on Australia's main grid in 2025.