|

Your Democracy

Monday, December 8, 2025 - 07:44

Source

Australia’s new Defence Delivery Agency may finally expose an uncomfortable truth – that Australia already has formidable deterrent capabilities through the Royal Australian Air Force and emerging drone systems, making the AUKUS submarine commitment both risky and unnecessary.

|

Renew Economy

Monday, December 8, 2025 - 07:03

Source

|

|

MacroBusiness

Monday, December 8, 2025 - 07:00

Source

From the Market Ear: Got commodities? “Trump runs it hot, oil bounces post Russia-Ukraine fix, China keeps yuan cheap, soon all the commodity charts will look like gold…” (BofA) Energy XLE has been stuck inside the same range since March 2022. Things could get very squeezy should we take out current range highs. The 30 The post Markets heat up (almost) everywhere appeared first on MacroBusiness. |

Your Democracy

Monday, December 8, 2025 - 06:55

Source

Merz hails Germany's friendship with Israel on first visit Merz in Israel: Working toward goal of 'new Middle East'Kieran Burke | Karl Sexton | Emmy Sasipornkarn | Timothy Jones dpa, AFP, Reuters, AP, epd, KNAThe German chancellor said "lasting peace is possible" in Gaza and that the possible establishment of a Palestinian state, alongside Israel, offered the best prospect for future peace. DW has more. |

|

Your Democracy

Monday, December 8, 2025 - 05:45

Source

China now dominates in every technology that defines the modern world. |

MacroBusiness

Monday, December 8, 2025 - 00:05

Source

Former Treasurer Peter Costello has told an e61 Institute event in Sydney that the federal government should consider reintroducing the baby bonus. Costello’s 2002 budget introduced it, giving parents $3,000, but it was wound back about a decade ago. Australia’s fertility rate is now at a near-record low of 1.48 births per woman, with the The post Cheaper housing is the antidote for falling fertility appeared first on MacroBusiness. |

|

George Monbiot

Sunday, December 7, 2025 - 23:08

Source

A eureka moment in the pub could help transform our understanding of the ground beneath our feet. By George Monbiot, published in the Guardian 5th December 2025 It felt like walking up a mountain during a temperature inversion. You struggle through fog so dense you can scarcely see where you’re going. Suddenly, you break through the top of the cloud, and the world is laid out before you. It was that rare and remarkable thing: a eureka moment. |

Renew Economy

Sunday, December 7, 2025 - 21:24

Source

|

|

MacroBusiness

Sunday, December 7, 2025 - 10:00

Source

By Trent Saunders, Senior Economist at CBA The Q3 25 GDP figures pointed to an economy on a much more solid footing when compared to the last few years. GDP improved to be 2.1% higher over the year, up from a low of 0.8%/yr in Q3 24. The October Monthly Household Spending Indicator (MHSI) rose The post The economic week ahead appeared first on MacroBusiness. |

Your Democracy

Sunday, December 7, 2025 - 08:58

Source

|

|

Renew Economy

Sunday, December 7, 2025 - 07:51

Source

|

Your Democracy

Sunday, December 7, 2025 - 06:55

Source

Delivered as remarks to Brown University’s Watson School during its “China Chat” series, Chas Freeman reflects on China’s return to global prominence and the United States’ accelerating retreat from the international order it once led – and asks what coexistence looks like as power shifts in the 21st century.

|

|

Digitopoly

Sunday, December 7, 2025 - 05:29

Source

From a firm’s perspective, the emergence of a new technology wave is a new opportunity to generate a financial return. The question is precisely how. That topic remains as salient today, in the era of artificial intelligence, as it was when firms first encountered smartphones, the commercial internet, and personal computers. Before we fully embrace this new era, let me suggest that we review lessons from the most recent era of technology adoption. In particular, let’s focus on consumer computer technologies (CCTs) – the mix of the mobile ecosystem and the widely used internet, enhanced by Web 2.0. |

Your Democracy

Sunday, December 7, 2025 - 03:33

Source

RT’s editor-in-chief Margarita Simonyan has been included in the Financial Times’ list of the world’s most influential people for 2025, after years of “propaganda” slurs and criticism by the British outlet. |

|

Your Democracy

Sunday, December 7, 2025 - 03:22

Source

A “just peace” between Russia and Ukraine is only possible if the sides agree to halt the fighting along the current front lines and then move on to talks, Ukraine’s top military commander, Aleksandr Syrsky, has said. Moscow has argued that a pause would only benefit Kiev and allow it to regroup its battered army. |

Your Democracy

Sunday, December 7, 2025 - 02:47

Source

It is one thing to produce a written national security strategy, but the real test is whether or not US President Donald Trump is serious about implementing it. The key takeaways are the rhetorical deescalation with China and putting the onus on Europe to keep Ukraine alive.

|

|

Your Democracy

Saturday, December 6, 2025 - 16:39

Source

Ireland, Spain, the Netherlands and Slovenia will boycott the 2026 Eurovision Song Contest, after it was decided Israel could compete. They were among a number of countries who had called for Israel to be excluded over the war in Gaza and accusations of unfair voting practices. |

MacroBusiness

Saturday, December 6, 2025 - 15:59

Source

Cotality’s September housing affordability report showed that Sydney’s housing market was easily the most expensive in the nation, with a dwelling price-to-income ratio of 10.0. The percentage of median household income needed to service a mortgage on the median-priced Sydney home was also tracking at a historically high 54.5% in the September quarter, making Sydney The post Gravity catches up with Sydney house prices appeared first on MacroBusiness. |

|

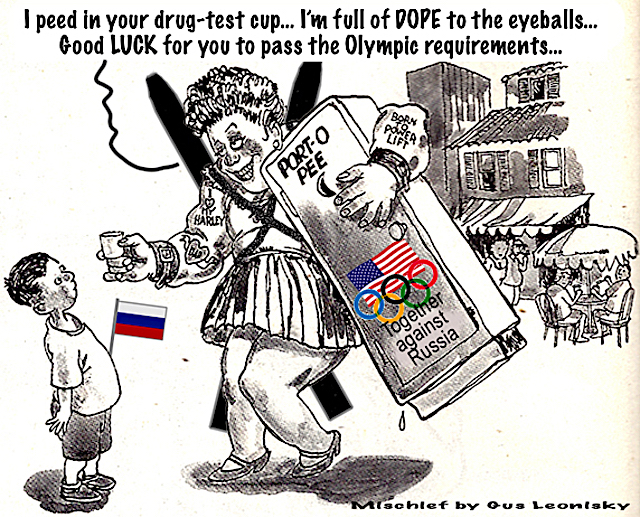

Your Democracy

Saturday, December 6, 2025 - 15:33

Source

The International Olympic Committee on Friday announced that athletes from Russia will once more be allowed to compete at the 2026 Winter Olympics under a neutral banner if they meet strict conditions. "The Executive Board will take the exact same approach that was done in Paris," said IOC president Kirsty Coventry, referring to last year's Olympics where Russian athletes could only take part under a neutral flag and in individual events. |

Your Democracy

Saturday, December 6, 2025 - 15:08

Source

|

|

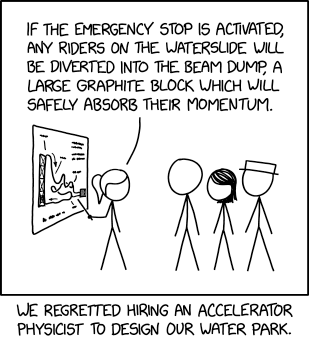

xkcd.com

Friday, November 14, 2025 - 11:00

Source

|

Renew Economy

Wednesday, November 12, 2025 - 16:56

Source

|

|

Renew Economy

Wednesday, November 12, 2025 - 15:22

Source

|

Renew Economy

Wednesday, November 12, 2025 - 14:51

Source

|

|

MacroBusiness

Monday, November 10, 2025 - 13:30

Source

IEEFA wants Albo to waste another $1bn on green iron. As Australia pours $1 billion into its Green Iron Investment Fund, it can learn important lessons from the US and EU, where several low-emissions steel projects backed by capital grants were subsequently cancelled or delayed. Projects with a “gas first, green hydrogen later” approach struggled, The post Green iron and steel in a deep freeze appeared first on MacroBusiness. |

Cheeseburger Gothic

Monday, November 10, 2025 - 13:20

Source

|

|

MacroBusiness

Monday, November 10, 2025 - 13:00

Source

China printed a bit of inflation in October, but it was pretty obviously seasonal. There is bugger all momentum in prices. The PPI was worse, though it also fell over the line in the month. Anti-involution has dented deflation but it is temporary. Bloomberg has some great charts on the great deflation. Rise of The post Chinese Titanic sucked into deflationary depths appeared first on MacroBusiness. |

MacroBusiness

Monday, November 10, 2025 - 12:30

Source

It is time to shutter the ABC. Flag burning should be criminalised, immigration should be capped based on housing supply, and the ABC and SBS should be sold and replaced by a taxpayer-funded broadcaster only for regional and outback Australia, according to resolutions to be debated at the Liberal National Party’s state council this weekend. The post Time to cancel the ABC appeared first on MacroBusiness. |

|

MacroBusiness

Monday, November 10, 2025 - 12:00

Source

Last week, I reported an AFR analysis of 16 financial reports from federal agencies, which revealed that 14 had unbudgeted increases in staff expenses totaling $841 million. Budget watcher Chris Richardson warned that the wage blowout could threaten the federal budget’s March forecast of a $42 billion deficit for this financial year, as could the billions The post Australia’s bloated bureaucrat economy appeared first on MacroBusiness. |

MacroBusiness

Monday, November 10, 2025 - 11:30

Source

With the election of Zohran Mamdani to the office of Mayor of New York, an event thought practically impossible just a few decades ago has come to pass: the most populous city in the United States and the centre of the financial world has an avowed socialist as its mayor. His victory speech possessed themes The post New York turns hard left, the driving numbers appeared first on MacroBusiness. |