|

Renew Economy

Monday, October 6, 2025 - 12:14

Source

|

MacroBusiness

Monday, October 6, 2025 - 12:00

Source

Anyone who thinks attaining Labor’s 82% Renewable Energy Target (RET) by 2030 is feasible or affordable is kidding themselves. To meet Labor’s fantastical target, much of Australia’s baseload coal generation—the backbone of the country’s energy grid—would have to be shut down and replaced with masses of intermittent and weather-dependent wind and solar generation, backed up |

|

Renew Economy

Monday, October 6, 2025 - 11:39

Source

|

Renew Economy

Monday, October 6, 2025 - 11:39

Source

|

|

MacroBusiness

Monday, October 6, 2025 - 11:30

Source

Under a series of treaties signed by the Australian and New Zealand governments, New Zealand citizens have the right to move to Australia and live there indefinitely under the Special Category Visa (SCV). The SCV is granted to Kiwis automatically upon entry, provided they meet health and character requirements. But despite having a pathway to The post NZ warns that Australia’s backdoor is open appeared first on MacroBusiness. |

MacroBusiness

Monday, October 6, 2025 - 11:00

Source

Following May’s election, the nation’s electorate fundamentally changed the requirements to pass legislation through the nation’s upper house. Prior to the election, Labor held 25 senate seats, with the Greens holding 11, giving them 36 votes in a chamber that requires 39 for an unassailable majority. When Parliament sat for the first time post-election, the The post The Greens hold the power appeared first on MacroBusiness. |

|

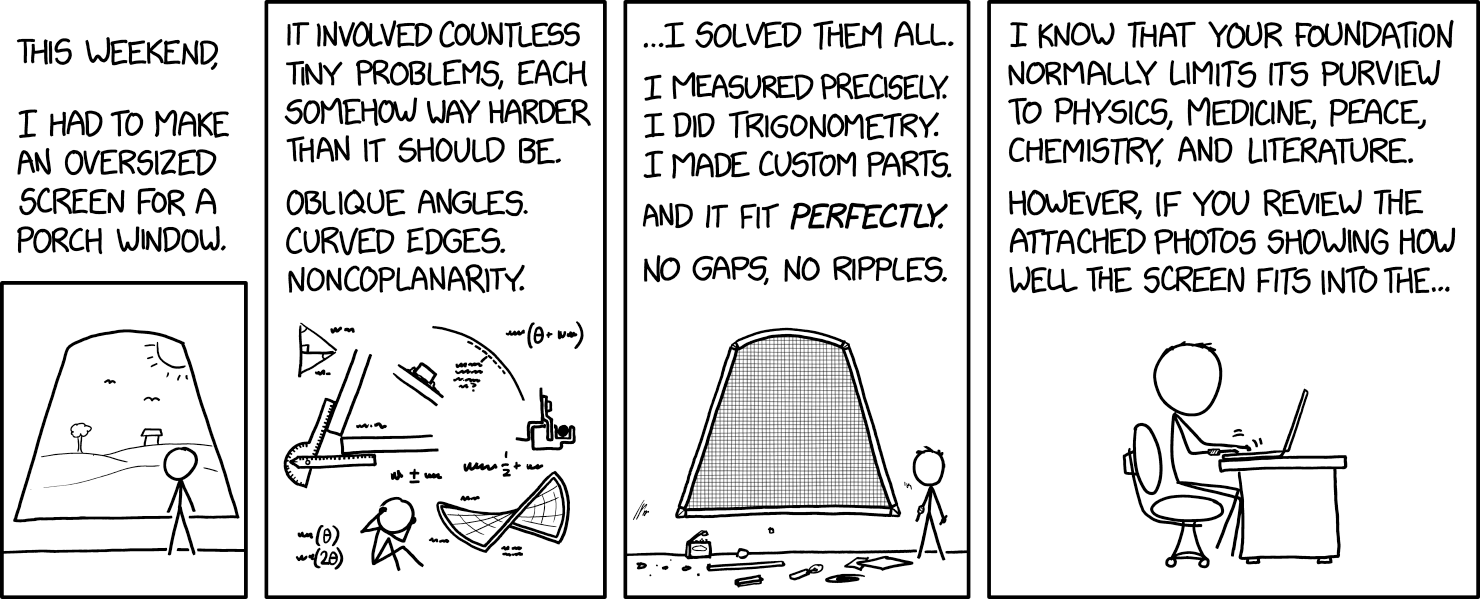

xkcd.com

Monday, October 6, 2025 - 11:00

Source

|

MacroBusiness

Monday, October 6, 2025 - 10:30

Source

The hyper-taut ferrous complex should not be confused with equilibrium. The market is indeed stable, but this is not owing to calm price pressures. Steel demand is stable due to exports. Steel production is far too high on anti-innovation stupidity. This is a market with Godzilla pulling at one end and King Kong at the The post The shared doom of iron ore and gas appeared first on MacroBusiness. |

|

MacroBusiness

Monday, October 6, 2025 - 10:00

Source

Over the last 35 years, the contribution of manufacturing to Australia’s overall economic activity has declined. While this trend is not unique to us, the reality is that Australia had a much smaller manufacturing base as a percentage of GDP than the average of advanced economies to begin with, making the relative decline all the The post A vulnerable China leaves Australia exposed appeared first on MacroBusiness. |

MacroBusiness

Monday, October 6, 2025 - 09:00

Source

Perfection prevails NDX continues trading inside the perfect trend channel that has been in place since May. Buying the 21 day remains a simple but profitable strategy. We are here Nothing new, but NDX seasonality from here is very strong. SPX +7300 SPX is +14%YTD. Goldman’s Garrett points out: “Only 4 other instances where SPX The post FOMO Mania Meets AI Nuclear Fever appeared first on MacroBusiness. |

|

MacroBusiness

Monday, October 6, 2025 - 08:00

Source

Real per capita household disposable income is considered the most reliable indicator of individual living standards. According to OECD data, Australia recorded the slowest increase in real per capita household disposable income among major English-speaking countries over the decade ending in the March quarter of 2025. Australia’s real per capita household disposable income increased by |

Your Democracy

Monday, October 6, 2025 - 06:56

Source

The current European nonentities have replaced titans—flawed, perhaps, but figures with gravitas, charisma, and historical will. There was Merkel, who could take a punch; Macron, young and with the ambitions of a new Napoleon; and even Johnson with his chaotic but distinct style

The EU’s House of Cards: How Talentless Pygmalions Are Molding a World Out of Nothingness |

|

Your Democracy

Monday, October 6, 2025 - 06:46

Source

George Orwell completed his most famous novel 1984 in 1948, shortly before his early death at 46. A few years earlier, in a remarkable short 1945 essay, Orwell foresaw a future world order overseen by America, Russia and China.

|

Your Democracy

Monday, October 6, 2025 - 06:00

Source

|

|

John Quiggin

Monday, October 6, 2025 - 05:27

Source

Another Monday Message Board. Post comments on any topic. Civil discussion and no coarse language please. Side discussions and idees fixes to the sandpits, please. I’m now using Substack as a blogging platform, and for my monthly email newsletter. For the moment, I’ll post both at this blog and on Substack. You can also follow me on Mastodon here. |

Your Democracy

Monday, October 6, 2025 - 01:15

Source

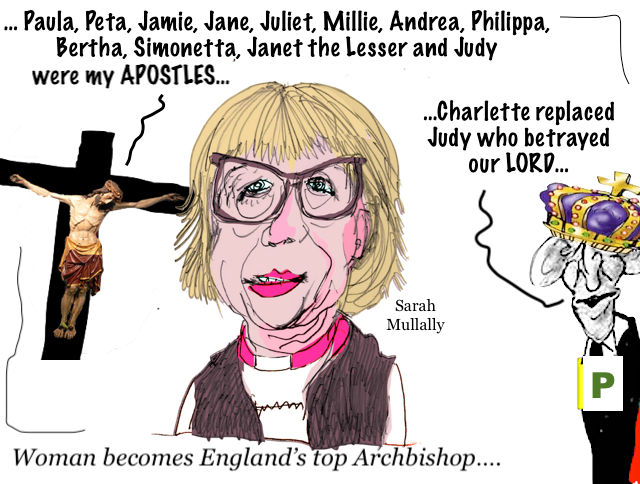

The Church of England has appointed its first female Archbishop of Canterbury, ending 1,400 years of male leadership. Former top British nurse, Sarah Mullally, was installed as the confession’s highest-ranking clergy by a church synod on Friday. Though female priests were first ordained in 1994, women were not permitted to take senior posts until 2014, a reform that followed years of internal schisms and debates within the Church. |

|

MacroBusiness

Monday, October 6, 2025 - 00:05

Source

Last week was an unmitigated disaster for Australian housing affordability. On Tuesday, the Australian Bureau of Statistics (ABS) released data on dwelling approvals, which showed that the number of homes approved for construction is falling badly behind the government’s target to build 1.2 million homes over five years, which requires 240,000 homes to be built The post The week housing affordability died appeared first on MacroBusiness. |

The Australian Independent Media Network

Sunday, October 5, 2025 - 16:44

Source

Rupert Murdoch built more than a media empire. He built a cathedral of grievance where facts die on the altar and paranoia pays the rent. [...] The post A Cathedral of Grievance: How Murdoch Built The Monster He Can No Longer Control appeared first on The AIM Network. |

|

MacroBusiness

Sunday, October 5, 2025 - 15:59

Source

By Trent Saunders, economist at CBA The RBA left the cash rate on hold at 3.60%, as expected, but the accompanying statement carried a more hawkish tone. We crystallised some of the upside risk to inflation in our forecasts this week, upgrading our estimate for trimmed-mean inflation in Q3 from 0.7% to 0.8%/qtr. This uplift The post The economic week ahead appeared first on MacroBusiness. |

Your Democracy

Sunday, October 5, 2025 - 07:41

Source

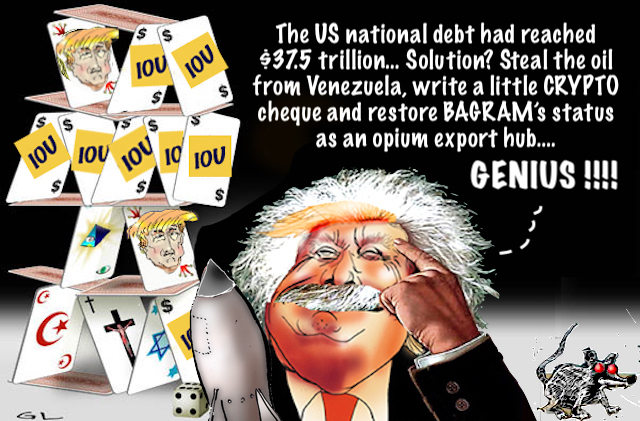

Monetary power and public debt BY Thomas Erpé

|

|

Your Democracy

Sunday, October 5, 2025 - 04:33

Source

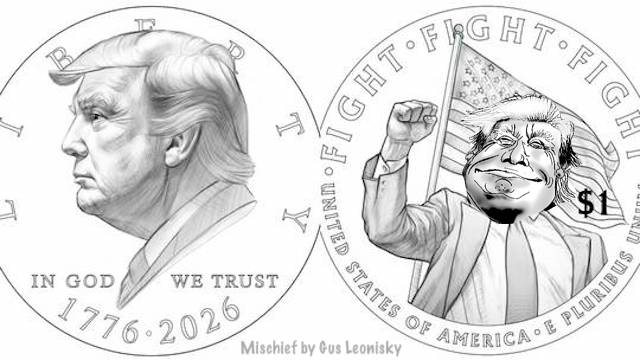

Given his behaviour, it could very well be that the president of the United States is going nuts. Over the weekend, on his Truth Social, Trump shared a video purporting to be a segment on Fox News — it wasn’t — in which an AI-generated, deep-faked version of himself sat in the White House and promised that “every American will soon receive their own MedBed card” that will grant them access to new “MedBed hospitals.” What?

|

Your Democracy

Sunday, October 5, 2025 - 03:22

Source

Civilisation is under attack from Australian doctors, warns pro-Israel psychiatrist Doron Samuell. Royal Children’s Hospital agrees. Wendy Bacon and Stephanie Tran investigate. |

|

Your Democracy

Saturday, October 4, 2025 - 19:19

Source

|

THE BLOT REPORT

Saturday, October 4, 2025 - 11:23

Source

Before and during the First World War, members of the German armed forces had sworn an oath of allegiance to the Kaiser. This changed after Germany’s defeat, and the establishment of a democratic Weimar Republic. Not only did the political leaders of the new Weimar Republic seek to democratise the military by changing its social makeup but also by changing the oath of allegiance. The new oath required soldiers to swear loyalty to the Constitution and its institutions, rather than to any individual. However, for many career soldiers, the idea of swearing an oath to a constitution was alien1. |

|

Renew Economy

Saturday, October 4, 2025 - 08:28

Source

|

Your Democracy

Saturday, October 4, 2025 - 05:55

Source

The Trump Plan is designed to reframe the issues in favour of Israel. Palestinians have been betrayed again. The indicted war criminal Netanyahu has got what he wants. The felon, Trump, so eager for a Nobel Peace Prize, has obliged him. Tony Blair’s involvement suggests satire rather than diplomacy.

|

|

Your Democracy

Saturday, October 4, 2025 - 05:25

Source

Russian president Vladimir Putin used his address at the Valdai forum on Thursday to issue a challenge: Western liberal societies are crumbling, convulsing in moral chaos, and Russia is emerging as a sanctuary of tradition. He warned of “gender terrorism” driving Europeans toward Russia, and spotlighted the televised killing of conservative American voice Charlie Kirk as evidence of the West’s internal collapse.

|

MacroBusiness

Saturday, October 4, 2025 - 00:10

Source

If you want bona fide proof that the Australian Treasury has become a propaganda arm of the federal government, look no further than its modelling of the impact of Labor’s 5% deposit scheme for first home buyers. Under Labor’s First Home Guarantee scheme, which came into effect on Wednesday, almost all first home buyers can The post Australian house prices are rigged to blow appeared first on MacroBusiness. |

|

MacroBusiness

Saturday, October 4, 2025 - 00:05

Source

International Reading: Trump Cuts Funding to 16 Blue States That Didn’t Vote for Him – New Republic Israel is paying influencers $7,000 per post – Responsible State Craft US home sales falling through as buyers get ‘cold feet’ – News Week The US economy lost 32,000 private-sector jobs in September – CNN Student-Loan Debt Is The post Weekend reading and MB media appearances appeared first on MacroBusiness. |

Your Democracy

Friday, October 3, 2025 - 17:33

Source

Ladies and gentlemen, journalists and news watchers of the Western world, lend me your biased ear….

I have a question for you. Why do you hate Russia? YOU HATE RUSSIA, DON’T YOU? Putin?… What’s not to hate about invading a neighbouring country and killing many people, you might say for starters…

|

As a private citizen, I have long sought to understand how finance has imposed its influence on the States themselves. I discovered, by consulting the most eminent economists, that the answer, far from being complicated, is quite simple, as described by Michael Hudson, an American economist, considered by his peers to be one of the greatest in the world....

As a private citizen, I have long sought to understand how finance has imposed its influence on the States themselves. I discovered, by consulting the most eminent economists, that the answer, far from being complicated, is quite simple, as described by Michael Hudson, an American economist, considered by his peers to be one of the greatest in the world....