The certainty of ever-growing living standards we grew up with under Queen Elizabeth is at an end

Much has been written about how, with the passing of the Queen, we have lost one of our last continuing links to the second world war.

We have, but we have also lost something even more profound – the link she gave us back to when the kind of world we know began.

On Tuesday last week Queen Elizabeth appointed a new prime minister of Britain, Liz Truss, who was born in 1975.

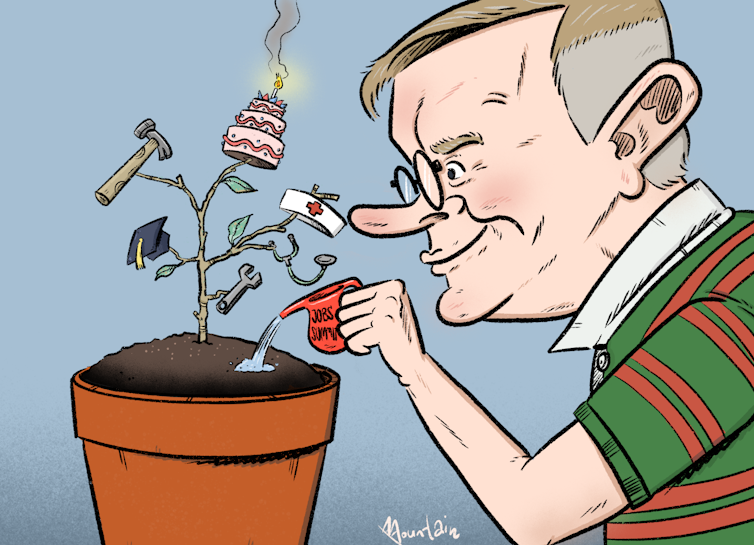

Wes Mountain/The Conversation,

Wes Mountain/The Conversation,  Wes Mountain/The Conversation

Wes Mountain/The Conversation