Generative AI has created a gold rush today, but that rush has not yet grown into either a productivity boom or a financial bubble. There are good reasons to think this rush could become either one.Which one is just around the corner? Could it be both? In case you forgot, we did live through a productivity bonanza that morphed into a financial bubble during the commercialization of the Internet. That alone makes it plausible to forecast that history will repeat itself a quarter of a century later. You may also have more self-centered reasons to pay attention. Suppose you work at one of the organizations making investments in generative AI, or you supply bandwidth and parts to cloud data centers that support the app makers. In that case, sometime soon, you will want to recognize whether a financial bubble has hijacked the economy’s productivity growth. In today’s column, we presume some productivity gains will emerge and focus on the basics of Financial Bubbles. Do today’s conditions resemble those that created a bubble in the late 1990s?

Why a bubble?Where should you start a class on financial bubbles? Let’s begin by explaining the price of a stock. For the sake of brevity, here is a simple explanation: it reflects investors’ collective perceptions and expectations about the company’s ability to generate profits and deliver shareholder value in the future. “Perception” and “expectations” are the crucial words. As perceptions and expectations fluctuate, so do firms’ stock prices. Many factors influence that collective judgment: a company’s recent financial performance, future growth prospects, assessments of its leadership and plans, market and regulatory conditions, macroeconomic trends, and the mood of the day. Financial bubbles arise when the price of many stocks departs from fundamental determinants and sustains that departure for a significant period. “Departs” and “sustains” are the two crucial words in that sentence. Financial bubbles are rare because gains in actual profitability determine outcomes in the long run, and departures do not tend to survive forever. A huge analyst industry is invested in scrutinizing firms, and analysts tend to keep valuations grounded in a thorough assessment. In most circumstances, skeptics can benefit from betting against a company when they can expect to be right more than half the time. The diffusion of new technology can alter such assessments when new technology alters a company’s prospects. A financial bubble becomes more likely – though not inevitable – when more firms’ valuations rely on the technology that has yet to be but is expected to be widely deployed. It opens the door to more speculation. If speculators care more about what others think than fundaments, it can lead to ungrounded views of the likely future. The boundary between ungrounded speculation and sober forecasting is not stark, however. In reaction to new opportunities, firms can (and do) make riskier investments as they try to direct efforts to improve their business by adapting technologies. That gives firms legitimate reasons to expend costs without revenue in the short term. In other words, at early moments, outside investors cannot easily distinguish between productive efforts to invest in early-stage technology and undisciplined speculative investments fueled by speculative hyperbole and magical thinking. That typically can be sorted out later, but it is often too late. It’s a fundamental and irreducible dilemma for managers of such projects and outside investors who must assess firms undertaking these projects.

Two examplesTwo notable recent examples from the late 1990s illustrate different aspects of financial bubbles during productivity growth: the Dotcom Bubble and the Telecommunications Bubble. Present events partially resemble the earliest events leading to both these bubbles. Long story short, the Dotcom Bubble was driven by the belief in the (seemingly) limitless potential of the commercial Internet and businesses built on the World Wide Web. “Limitless” is the crucial word. The commercial browser did astound in the winter of 1995, and email and browsing touched virtually every industry. At the time, it was only a question of how much more potential and demand there would be. In addition to the excitement over new business processes and previously unheard-of services, a view emerged that established firms lacked the necessary personnel and strategic insight to profit during the opportunity. Many investors concluded that entrepreneurs and startups could address the commercial situation faster and with better services. That pushed up valuations for startups, even for some startups with plans that placed all their profits in the future. It also pushed novel metrics into conversations. These metrics allegedly forecast whether these firms would generate revenue. Those metrics turned out to be over-optimistic at best or meaningless at worst. The Telecommunications Bubble occurred around the same time and upstream from the dotcom firms. It was driven by the rapid expansion of the telecommunications infrastructure, with investors pouring capital into emerging broadband and mobile communications services. While networking technology was (once again) transformative, overinvestment overtook many firms’ plans for realistic product development. Some chased the anticipated overinflated traffic forecasts for the dotcom firms, while others lost control over costs, making investments that did not generate sufficient customer revenue. Dishonesty contributed to sustaining the bubble. A few firms, such as Enron and WorldCom, hid information or reported deceptive information, sustaining unrealistic perceptions about their success. An inaccurate assessment of the financial state of these organizations did set unrealistic norms for other competitors. Honest reporting might have ended the bubble sooner. Make no mistake. There were gains. The economy experienced productivity growth over most of the later part of the 1990s. But a financial bubble colored those gains with a layer of wasteful investment that looked pointless in retrospect.

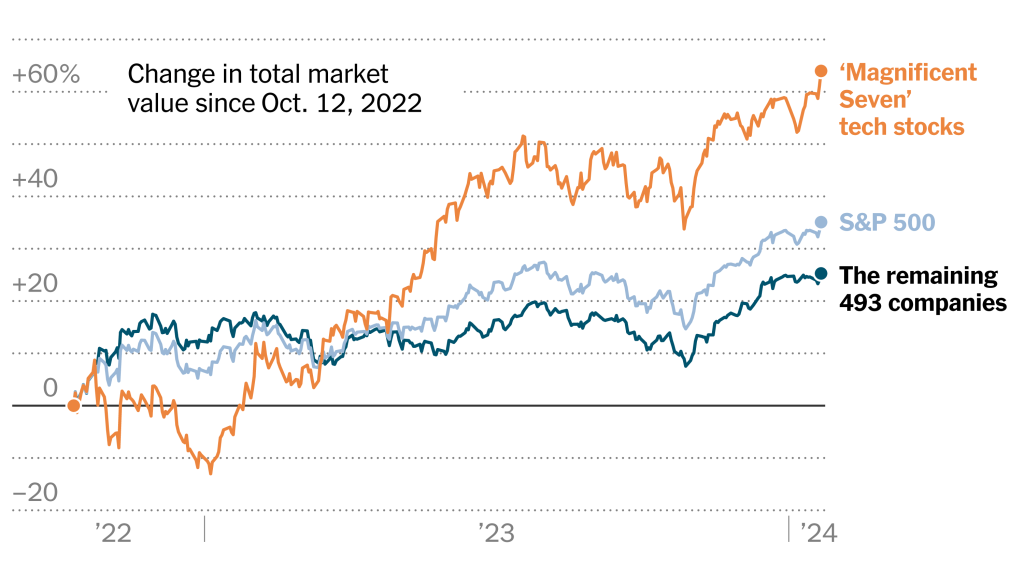

Will history repeat itself? In a bit of technological déjà vu, generative AI has produced astounding results, and a frenzy has followed, with each week full of new astonishing prototypes. The rollout of ChatGPT in November of 2022 changed investors’ perceptions. Today, an incredible set of prototypes can be found on Hugging Face and GitHub. Co-Pilot and other coding assistants are striking examples of business tools that users genuinely value. Technical talent markets offer another comparison. Skill shortages did not limit the growth of web-based businesses during the dotcom boom, partly because coders easily mastered the front end of the web. Additions to servers and other backend tools required more technical experience to create and commercialize, however, and a boom took off there, too, after coders mastered the parameters. Similarly, any skilled equipment engineer could get a job during the telecom bubble, but events were comparatively held up by their availability. By comparison, the core models for generative AI remain the purview of a comparatively small group of experts. Considerable energy has gone into democratizing applications of these core models, making them accessible to those without technical background and on mobile devices. If those efforts succeed (as I think they will), there will be plenty of talent to create office applications and adapt existing software by adding new features. A third, albeit more speculative, parallel applies to the breadth of applications. There are plans to adapt generative AI to various business processes. Still, how broadly will generative AI touch a set of markets? That is an open question today because it depends on how quickly (or slowly) users accept and adapt the new capabilities to their needs. A significant difference arises between financial analysts in the past and today. The growth of generative AI has unleashed a new round of scrutiny aimed at what firms hope to achieve with significant investments in AI. Unlike the 1990s, however, the investment community has decided that startups will not displace every established firm. That reflects real investments: many established firms are also heavily investing in generative AI development and commercialization. This was not so much the case back in the 90s with the internet and telecom bubbles when the internet caught IBM and AT&T flat-footed.A symptom of that belief can be found in the stock valuations of seven large firms – Amazon, Apple, Alphabet/Google, Meta/Facebook, Microsoft, and Netflix, with Nvidia especially enjoying a rise. Notably, a broad set of firms beyond these seven have not enjoyed such an optimistic assessment, at least not yet, so one should consider this assessment contingent and fluid. Some of that assessment also depends on whether access to generative AI becomes democratized and, if so, how fast and whether it deploys widely or narrowly. That will take time to resolve.Still, an analyst faces whopping challenges today. No commercial analyst today can fully digest the situation in generative AI and assess whether a firm’s actions are sufficiently grounded in genuine value-creating activities. At this stage, there is little observable difference on the surface between a speculative investment and a thoughtful one.

Conclusion and wildcardsLooking ahead, financial analysts on Wall Street are a wildcard. In the late 1990s, many financial analysts followed day traders and financial mobs, who bought into the hype, touting a range of newly invented metrics other than revenue and cost. What stops today’s analysts from playing to the worse instincts of investors, just as they did in the late 1990s? National policy for generative AI is another wildcard. Today, we live with a complex regulatory landscape across the globe. Will courts, regulators, or representatives in many governments make significant changes to AI policy soon? Your guess is as good as mine. A final wildcard is interest rates. In the latter part of the 1990s, interest rates were low, encouraging speculative investment. The economy just left an era of low-interest rates. While they are higher today, it is unclear where they will go next year. It will continue to pay to monitor and ask probing questions: Are users willing to pay for an application? Do one competitor’s applications deliver value better than another? How are business users reacting to new applications? Does that value generate revenue from a business customer who foresees saving costs or generating additional services? Those questions require homework, and there will be no substitute for hard-earned conclusions.

Copyright held by IEEE Micro

April 2024