Just a decade ago, Australian labour was easy to find and infrastructure projects were often no-brainers. Now our economic times seem to have changed – and policymakers may need to adjust to a new set of rules.

The world is always changing, but sometimes parts of it change uncharacteristically fast.

Take the 1970s. Anyone under 60 has little memory of the economic world before 1973. But in that year, oil prices soared, unemployment started to rise, the Bretton Woods agreement continued unravelling – in short, the rules changed substantially, and forever. Most of us have spent most of our lives in this world.

In the 2020s, it seems arguable that the rules are moving again. The challenge of this era is to manage changing resources constraints. We struggle with an emerging scarcities of human resources, but also scarcities of labour-related resources, such as housing, and possibly of capital. But we also have emerging new abundance in important areas.

Not surprisingly, governments seem reluctant to move away from the thinking that served them pretty well just a decade ago. Most politicians grew up in that world, and its strategies seemed to work. So those politicians are mostly reluctant to drop those strategies now and pursue new strategies adapted to our new resource constraints.

It’s not just generals who want to fight the last war.

Reining in the 2010s infrastructure spending

Here’s a recent paradigm case of ignoring resource constraints: the Victorian government’s Melbourne Suburban Rail Loop, an underground railway line through the middle suburbs of Melbourne. To build the Loop, the government currently plans to borrow more than $100 billion dollars. Most urban transport experts say these suburbs don’t warrant such facilities, but the government has stuck to its loopiness even after the departure of the loop’s chief backer, former premier Dan Andrews.

But now rising debt costs mean Victoria’s state Budget is suddenly looking … um, “pressured”. Though it might be too late for the Victorian government to stop now without losing face, it’s increasingly obvious that this project should never have been started.

I’ve written plenty about the Loop project. But the same pattern seems to apply to the energy transition, mostly overseen by an LNP government.

Australia is committed to sharp emissions reductions over the next quarter-century. That means reconfiguring our electricity transmission system. It also means replacing much of our existing energy infrastructure with solar panels, wind turbines, batteries and other systems, such as what is called “pumped hydroelectric storage”. In such a system you take water from the bottom of your hydroelectric system and pump it back uphill, using cheap power that might come from people’s rooftops on a sunny day – and run that water back through your hydro plant when it’s needed on an overcast day or a hot night.

If current projects are anything to judge by, the task of replacing Australia’s electricity infrastructure is going to be messy. The example par excellence is what began life as “Snowy 2.0”, back in the days when “2.0” was the sort of snazzy modern name you gave to a building project to make it seem more sexy.

When Malcolm Turnbull announced this project in 2017, it was a “visionary $2 billion expansion of the iconic Snowy Hydro scheme”. Declared Turnbull: “I am a nation-building Prime Minister and this is a nation-building project.” Yes, he really said that. He might have been less enthusiastic if he’d known the expansion would cost at least $12 billion and take at least 11 years to complete, but those are the latest projections.

Some of this Snowy 2.0 problem was the normal, well-documented, politically-induced stupidity that surrounds such megaprojects. Some of it was the discovery – apparently completely unexpected, if you can believe it – that parts of the Snowy Mountains are made of quite soft rock. And some it was labour constraints. The case seems strong that this project, too, should simply never have been started.

Australia actually has institutions designed to assess these projects rigorously, but governments keep finding ways to go around them.

- Infrastructure Australia was set up by Kevin Rudd in 2008 to, in the words of Rudd government infrastructure minister Anthony Albanese, “develop a strategic blueprint for the nation’s future infrastructure needs”. It has not so much presided over an orgy of badly-planned infrastructure as been sidelined by it.

- The same is true of Infrastructure Victoria, which Dan Andrews established to “take short-term politics out of infrastructure planning … ensuring Victoria’s immediate and long-term infrastructure needs are identified and prioritised based on objective, transparent analysis and evidence”. Andrews cut Infrastructure Victoria out of the Melbourne Suburban Rail Loop debate by simply making the Loop official government policy, at which point his objective infrastructure analysis body was legally unable to look at it any more.

It’s possible that 10 years from now, a chastened Australia will understand better the need to take such institutions seriously.

Australia has also had a really good policy for helping the private sector to make the necessary energy infrastructure decisions here – carbon pricing. But in 2014 we scrapped that policy. And the second-best measures we turned to instead were pretty poor (and we dodged most of them anyway). So for the past decade we’ve been stuck in an environment that was likely to produce poor long-term outcomes.

That’s another structure we need to fix. And given the lousy outcomes from second-best solutions, we might want to resurrect carbon pricing again. There’s some evidence that it’s much more popular than it was a decade ago.

Building labour

Put those infrastructure-building issues aside for a moment, and look at the problems of building in a more general sense – because that’s another place this new reality seems to be showing up. Australia right now is trying to build a lot more transport infrastructure and a lot more energy infrastructure and a lot more housing, all at the same time, and making bad decisions in all three places.

Infrastructure and housing seem to take up closely related sorts of labour – to the point where people talk about the infrastructure boom making it harder to get a house built. (We don’t actually know for sure how true this is. But anecdotally, plenty of builders and engineers trying to hire labour believe it’s true.)

This means the next decade is a great time to be an engineer, or an electrician, or a masonry specialist, or a rigger, or a house painter. These are all trades jobs, not the desk jobs which we’ve spent the last 60 years telling people to train for.

We haven’t really thought of Australian trades labour as being in short supply over the past 50 years. But now trades labour really is scarce, and it will probably stay that way for at least a little while.

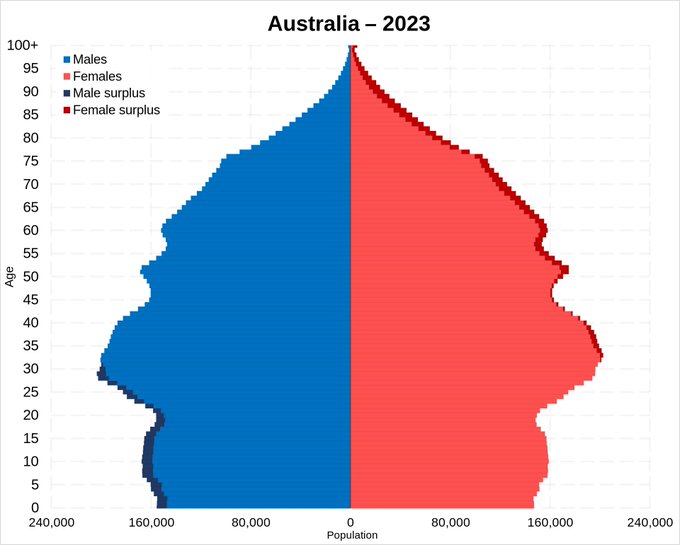

Take a look at the graph below, which signals a developing shortage of young people, and you may see what I mean.

The federal government seems slow to wake up to this. It has put out exciting new targets for the number of homes it wants built. And then … everyone with any command of the resources needed to build these homes has looked at these numbers and smiled sadly, because there’s almost no chance of reaching these figures. Australia literally lacks enough skilled trades workers to build this many homes in this time-frame. And homebuilding isn’t attracting many of the best workers anyway. If you’re in the building trades, you might be awfully tempted to see if you can get a job on a big long-term project such as Melbourne’s Suburban Rail Loop project, where pay promises to be spectacular. That is, as long as the Loop isn’t cancelled.

A training gap

A closely-related problem is the training of building labour.

You might think that Australian governments would be going flat-out to provide the training needed for building jobs. In reality, you don’t hear Anthony Albanese – or any other federal or state minister – going on about this very much. Most politicians devote surprisingly little time to focusing Australia on raising the skills base needed to supply labour for even the current level of building. They mostly act as if trades were still low-income jobs, while most of the tradies I know (including some members of my extended family) are doing very nicely, thanks.

TAFE’s shortcomings were well documented in a 2021 review by Peter Shergold and David Gonski. One obvious problem is that we’re spending less and less, relatively speaking, on training people for the building trades.

You might think the building trades are an ideal topic for Albanese, who like other left-wing politicians around the world is trying to stop the former ALP base – working-class men – from drifting off to parties on his right. But if Albanese has made trades a big part of his platform, I haven’t heard about it.

Could someone remind me of the last time a politician said, loudly: “trades jobs are great, and here’s my plan to train a lot more skilled tradies”?

Maybe we can find an AI entity to say it.

Other Australian governments are starting to realise that they’ve mismanaged their cities by locking up large areas of inner and middle suburbia in one-storey houses that are now over-zealously protected by heritage rules. (I live in one such area.) The new NSW Labor government, in particular, now seems committed to easing the regulatory constraints on new home-building close to Sydney.

But it turns out that removing the constraints directly imposed by governments is not enough to solve the short-term problem. Not matter how many homes we plan to build next year, we just don’t have the skilled workers.

Australian building labour and training needs are not really co-ordinated by any institution of note, and it’s possible they should be. Setting up some body isn’t enough, though; it needs to be imbued with real authority, which usually takes time.

Even if we start working harder tomorrow to fix this problem, it will takes many years to solve.

Immigration

All this probably means the current nascent debate about immigration will continue. My instinct is that this debate is now only peripherally about ethnicity (which seems to have been a genuinely important element of our 1990s debate). Instead, today’s immigration debate has most of its roots in uncertainty about whether we should prioritise bringing in more labour or housing the people we already have.

This debate has a long way to go, but it is already drawing in some interesting players. The Grattan Institute put out a surprisingly little-noticed report at the end of 2023 arguing that the government should slow overseas student visa applications by raising their price, and limit work visas for both holidaymakers and overseas students who’ve finished their course. (Note that clamping down on overseas students also means reducing Australia’s income from overseas students.)

Capital for governments

The same story may or may not apply to the capital needed to build all this stuff.

Over the 2010s in particular, as the price of capital descended for a while to truly spectacular lows, governments figured out that they could borrow cheaply. And cheap borrowing got them through the COVID crisis too. Indeed, in 2020 the states were egged on by none other than Reserve Bank governor Phil Lowe. He was one of many telling them that interest rates would remain low for years.

But since COVID, real interest rates have been returning to something closer to their long-term norm – and governments are only now starting to notice. They’re borrowing more and more for big projects, getting less and less in return, as rates have risen and risen. (The rate rises killed Lowe’s chances of a second term in the governorship, arguably making him one of the first highest-profile victims of this changing resource picture.)

I’m reluctant to make predictions about the future of capital prices. Chinese investment patterns are changing, and it’s hard to tell what that will mean for the price of money in coming years. But it seems at least possible that the recent boom in western governments’ investment spending won’t end well for all of the players.

Cheap energy

Yet while some resource constraints are growing, some are easing. One case in particular stands out – an important resource which is becoming cheaper. That resource is a particular kind of energy, for which we don’t really yet have a common term, although I bet we will soon. It’s energy whose customers don’t care when they get it. It’s the energy you’re happy to use just for a few hours in the middle of sunny days. That energy seems likely to become almost costless.

Put aside all the many short-term costs of reconfiguring our electricity grid, mentioned above. We are just not used to thinking about how our economies might change when we sometimes have a lot of energy available for almost nothing in the middle of many (but not all) days. But that’s the world we’re going into – a world full of solar panels that at some times of the day can pump out so much energy that the price goes almost to zero.

You may be tempted to say that such power is not that useful, and you may be right. But we’ve never before lived in a world where this powerful commodity – electricity – varied so much in price. My guess is that we will soon find interesting new uses for that sort of intermittently dirt-cheap power, beyond just running our washing machines at midday.

Of course, cheaper solar makes the bundle of solar and batteries more attractive, which will drive more investment in battery storage technologies. There’s a good chance this will continue to drive a virtuous circle as both technologies keep getting cheaper for some years to come. If that happens, the shape of the energy challenge may eventually change again. Years from now, long after power become radically cheaper for part of the day, storage advances may make it cheap for large parts of the year. I’ll be interested to see what that brings.

Cheap brainpower

The last resource whose availability is changing is probably the most important of all: brainpower. Two trends of the past 30 years come together here: in an astonishingly short time, the rise of a global middle class (made possible largely by western promotion of open global trade) has doubled, tripled, and then quadrupled the quantity of educated minds in the world. Simultaneously, the Internet has allowed us to connect to all of them.

I suspect this is very bad news for parts of the western middle class, whose pay premium is disappearing. But for anyone who can figure out how to take advantage of it, this is very good news indeed.

Time to change mindset

I’m not that sure about any of this. But the recent record does suggest that Australia has been slow to adjust to changing resource constraints. Time to think about change?

Now use the comments to explain what I’m missing, why this is trite, why I’m an idiot, etc. If possible, cite sources.