Quick quiz. Suppose you read a headline in the online version of the Wall Street Journal (or NY Times etc) stating that, from now on, US Treasury bonds would be redeemed in crypto. Would your response be

(i) That’s absurd. Either it’s April Fools Day or someone has hacked the website

(ii) That’s unlikely. Surely [1] Wall Street will be able to kill this crazy idea

(iii) That will be tricky. Which cryptocurrencies will be included and what will be the exchange rates?

If your answer was (i) you can stop reading here (and don’t bother commenting to justify your position). This answer assumes that, despite Trump’s bluster, nothing has fundamentally changed. You’re still in the denial stage, with six more to come..

If you’re answer is (ii) or (iii) you are paying at least some attention. I’ll point to some evidence suggesting (iii) is a plausible answer, and look at what that implies for the global financial system.

Looking specifically at debt, the idea of defaulting on US government debt, or threatening to, has long appealed to Republicans. Here’s a piece I wrote back in 2013 [2] Unsurprisingly, Trump has embraced the idea, suggesting not only that a default might not be too bad, but also that some (unspecified) debts might be fraudulent.

But there are lots of other possibilities. One, raised by Paul Krugman is that the US Federal Reserve might be coerced into understating the inflation rate, thereby reducing the return on Treasury Inflation-Protected Securities.

Another, already taking place, is that the government may be able to coerce private banks into reversing legal payments. Henry Farrell and Felix Salmon discuss this here.

The longer-term implication is that the existing global financial system, built around the US dollar can no longer be regarded as a reliable basis for organising trade, investment and banking. Some alternative will have to be constructed at an international rather than global levle. Moreover, this will have to be done on the fly, as the existing system crumbles around us.

This will doubtless be seen as good news for the BRICS countries, which have long chafed under the dominance of the dollar. But the obvious alternative, the Chinese Renminbi (aka yuan) is no better. As well as not being fully convertible, it is subject ot the political control of the CCP dictatorship.

An important point to start with is that the rapid growth in international financial integration that characterised the era of neoliberal globalisation came to an end with the Global Financial Crisis. As in this case, at least part of the adjustment to the end of the US will occur autonomously, as investors either steer clear of US financial markets or decide to play the increasingly corrupt games that will be required to survive there.

In this context, it’s crucial to understand the “weaponisation” of the global financial system, most notably by the US, as discussed by Henry Farrell and Abe Newman. The most striking instance of this so far has beem the seizure of Russian financial assets after the 2022 (further) invasion of Ukraine. Most of these assets were held by EU financial institutions, which Putin imagined to be safe from the US.

Until now, the main complaint of critics about weaponisation of the financial system was that it was being overused in the pursuit of secondary objectives But with Trump in power, it will be used to do direct harm. Reliance on the US dollar is giving hostages to his regime.

Deconstructing and replacing a global system based on the assumption that the US is a reliable guarantor of stability will be a huge task, but the alternative of a system run by Trump and Musk is even worse.

We need to recognise that the idea of a single global financial system, which has been dominant since the 1980s, is done for. It’s not a loss to be mourned, but that won’t make the task of replacing it any easier.

I’m thinking about an alternative system, centred on the Eurozone, but incorporating other countries that don’t want to be dominated by either the US or China. That’s a mammoth problem

I’ll put up two ideas to start with.

The first is the need for unremitting hostility towards crypto. Should proposals for recognition of crypto as a reserve asset for the US turn into reality. the result will be to make the $US itself useless as a reserve currency. Governments and financial institutions outside the US should be ready to dump dollars if this looks like becoming a reality. In the meantime, financial institutions should be prohibited from dealing with it in any way, and individuals should be required to report crypto holdings and transactions.

My other suggestion is to take seriously a mildly snarky reference, in comments to my Crooked Timber post, to a “Brisbane Woods” conference. (I live near Brisbane and the allusion is to the 1944 Bretton Woods conference which established, among other things, the World Bank and the International Monetary Fund.) These were set up in Washington both because the US was by far the largest contributor and because they could be colocated with the US Treasury. The famous “Washington consensus” of the 1990s referred to the neoliberal policy views shared by these three institutions.

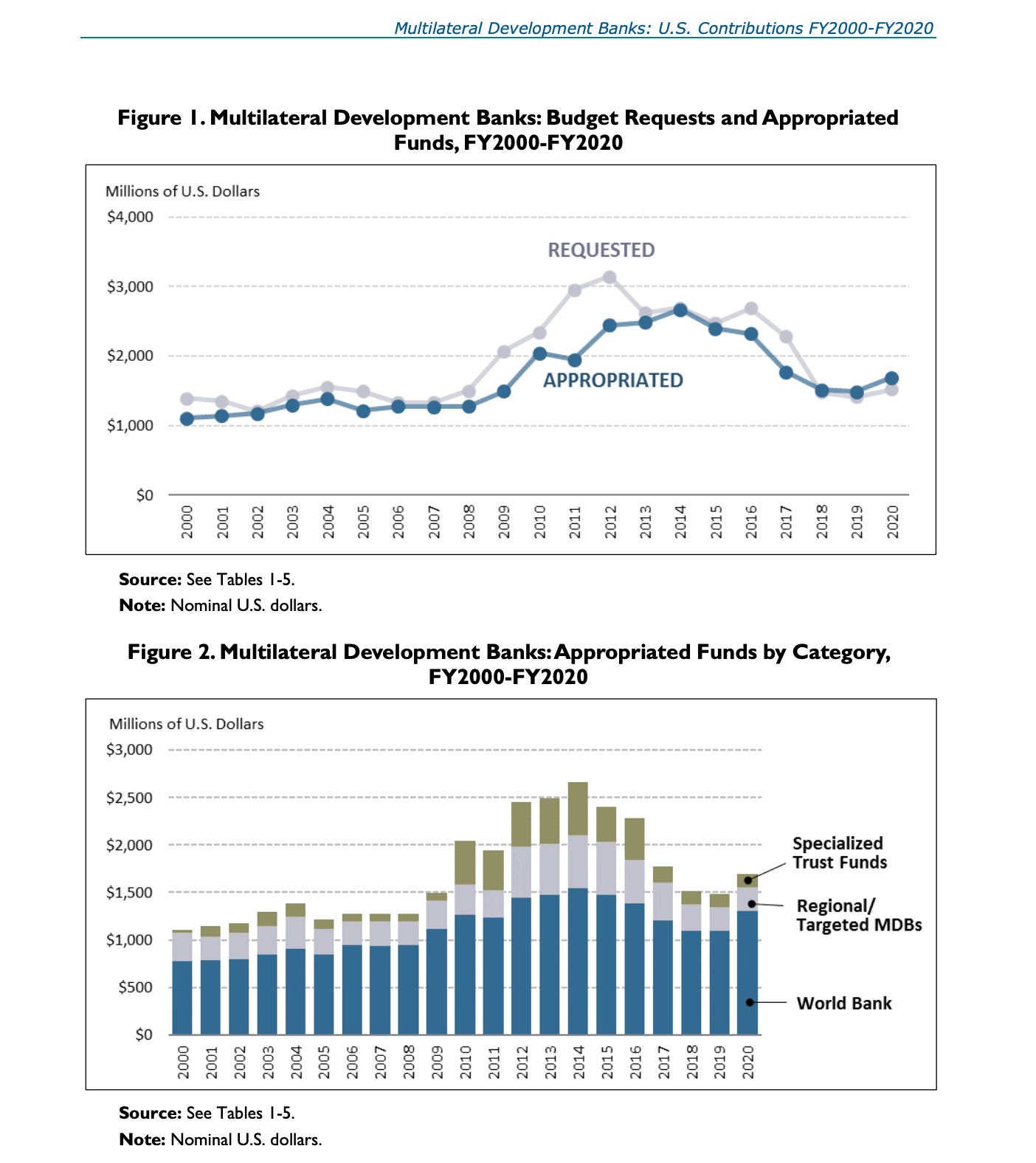

But US contributions have been dropping steadily in both real and nominal terms and will doubtless be cut further by Trump. And proximity to the Musk-controlled US Treasury is now a danger not an asset.

The World Bank needs to move out of the US and drop the convention by which the president is always a US citizen (along with the parallel convention where the IMF managing director is European). Rather than moving to a single new location, both the Bank and the IMF need a more decentralised setup, ideally with significant centres in every continent[3]. This would involve both competition and co-operation with the BRICS group, which shares the aim of breaking with $US hegemony, but is not so keen on legal and democratic governance.

Those items are challenging enough, and just scratch the surface of what needs to be done. But repeating myself from previous posts, the idea of the US as the indispensable centre of a stable and democratic global order is gone for good. The sooner we realise that, the better.

fn1. Quiggin’s Rule of Surely: It’s a Sure Sign that you are not Sure

fn2. I didn’t pick the headline which was obvious overblown even at the time. Now, if we wake up in four years time with Trump gone and nothing worse than a US default to worry about, it will have been the pleasantest of dreams

fn2. Except Antarctica and maybe Oceania, though of course Brisbane would be a great choice.

ShareSubscribed

Share John Quiggin’s Blogstack

Follow me on Bluesky or Mastodon

Read my newsletter