|

John Quiggin

Monday, December 1, 2025 - 09:01

Source

I’ve been seeing more and more alarmism about the idea that, on current demographic trends, the world’s population might shrink to a billion in a century or two. That distant prospect is producing lots of advocacy for policies to increase birth rates right now. |

John Quiggin

Monday, December 1, 2025 - 08:56

Source

Another Monday Message Board. Post comments on any topic. Civil discussion and no coarse language please. Side discussions and idees fixes to the sandpits, please. I’m now using Substack as a blogging platform, and for my monthly email newsletter. For the moment, I’ll post both at this blog and on Substack. You can also follow me on Mastodon here. |

|

Renew Economy

Monday, December 1, 2025 - 07:42

Source

|

MacroBusiness

Monday, December 1, 2025 - 07:00

Source

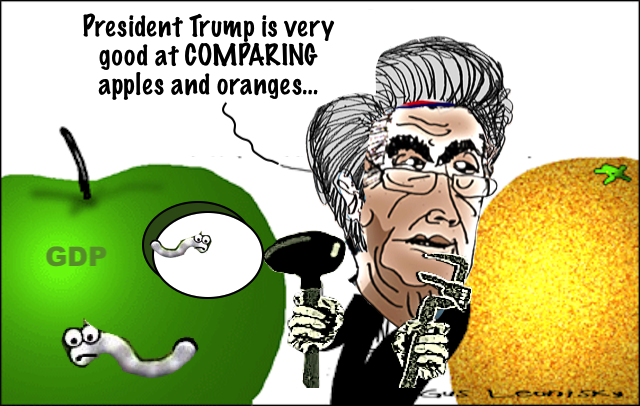

DXY held, but the uptrend looks set to be tested. AUD is ready to rise. CNY supportive. Gold whoa! Metals mania returns. The chosen one. EM lagging. EM junk warning. Yields firmed. Stocks too. Goldman reckons DXY is ready to fall meaningfully. We believe that as the US data backlog is slowly cleared it will The post Major bank: Australian dollar to rise into 2026 appeared first on MacroBusiness. |

|

Your Democracy

Monday, December 1, 2025 - 06:55

Source

|

Your Democracy

Monday, December 1, 2025 - 05:44

Source

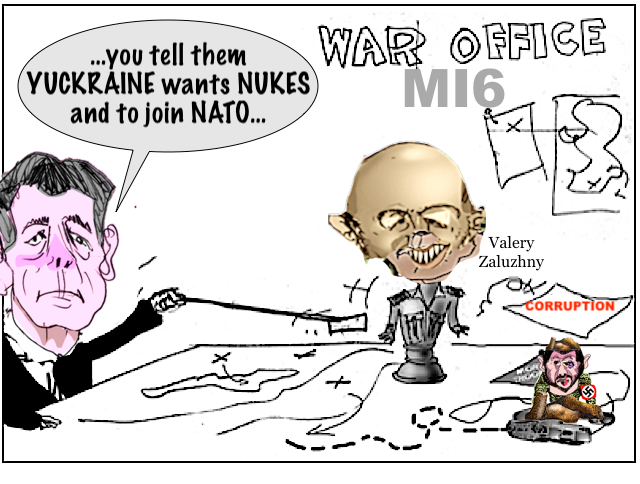

Only joining NATO, hosting nuclear weapons, or accepting a major foreign military force can truly guarantee Ukraine’s security, ex-top general Valery has claimed. Ukraine’s former armed forces commander-in-chief made the remarks in a piece run by The Telegraph on Saturday. |

|

Your Democracy

Monday, December 1, 2025 - 05:33

Source

In every era, certain industries become so large, so politically embedded, and so culturally unexamined that their performance ceases to matter. |

Renew Economy

Monday, December 1, 2025 - 00:13

Source

|

|

MacroBusiness

Monday, December 1, 2025 - 00:05

Source

Last week, Cotality released its housing affordability report for the September quarter of 2025, which revealed that rental affordability has hit its lowest level on record. The percentage of income required to meet advertised rents on the median home hit a record high of 33.4% in the September quarter, up from 26.2% five years earlier. The post Rental market “extremely tight”, no signs of easing appeared first on MacroBusiness. |

Renew Economy

Sunday, November 30, 2025 - 19:06

Source

|

|

MacroBusiness

Sunday, November 30, 2025 - 16:20

Source

By Lucinda Jerogin, Associate Economist at CBA: Australian headline inflation surprised to the upside, accelerating 3.8% through the year to October. The policy relevant trimmed mean measure increased to 3.3%/yr. The total volume of capex also recorded a strong turnaround, up 6.4% in Q3 25. Construction work done fell 0.7%/qtr, driven down by a decline The post The economic week ahead appeared first on MacroBusiness. |

Your Democracy

Sunday, November 30, 2025 - 14:31

Source

The cockroach saw my shadow And knew death was coming his way Equipped with a shoe a hammer and a spray I was tricked when he crawled into a hollow

Bastard

Through the floorboards behind the old wardrobe That had never moved since dad had died abroad While raking the dust with my panhandle I found an old badge that had seen battle

Weirdo

The square and the compass typical pack |

|

Renew Economy

Sunday, November 30, 2025 - 12:32

Source

|

Renew Economy

Sunday, November 30, 2025 - 12:20

Source

|

|

Your Democracy

Sunday, November 30, 2025 - 09:12

Source

Axios clarified the obvious this week: Ted Cruz is preparing to run for president, again. |

Your Democracy

Sunday, November 30, 2025 - 09:06

Source

Everything is more expensive these days, but especially those beauties already expensive to begin with. By the way, swung by the Colonel's place the other day and a bucket with sides is $50 now…and I heard the Confederates lost the war! (*joking*…the appellation is an Honorific in the Bluegrass State, of which a forbear of Yours Truly in fact bears the distinction…as seen here during the last Great Recession.) |

|

MacroBusiness

Sunday, November 30, 2025 - 07:58

Source

Cotality has released its daily dwelling values index for 30 November, which measures value changes across the five major Australian capital city markets. Over November, dwelling values increased by 1.0% at the 5-city aggregate level, with wide divergence between the individual capital city markets. Melbourne (0.3%) and Sydney (0.5%) recorded relatively soft growth, whereas Brisbane |

Your Democracy

Sunday, November 30, 2025 - 06:55

Source

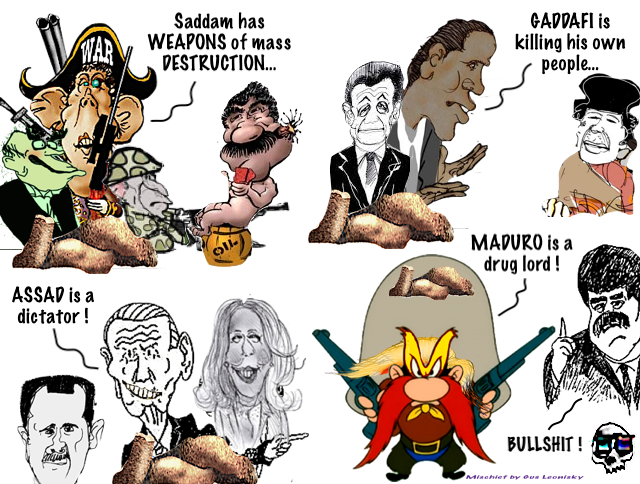

Airspace “above and surrounding”Venezuela is now closed, US President Donald Trump announced on Saturday. Trump has repeatedly threatened military action against the country, citing its alleged involvement in the illicit drug trade, a charge Venezuela’s leadership has consistently denied. Trump made the announcement in a caps-heavy post on Truth Social without elaborating how far the “surrounding” airspace spans beyond the South American country’s borders. |

|

Your Democracy

Sunday, November 30, 2025 - 06:25

Source

The Russian embassy in the UK has accused British media of misrepresenting President Vladimir Putin’s comments on the Ukraine conflict. The diplomats have pointed to coverage by certain outlets, including The Daily Telegraph, which it said allowed “serious distortions” of Putin’s remarks during his recent visit to Kyrgyzstan. |

Your Democracy

Sunday, November 30, 2025 - 05:44

Source

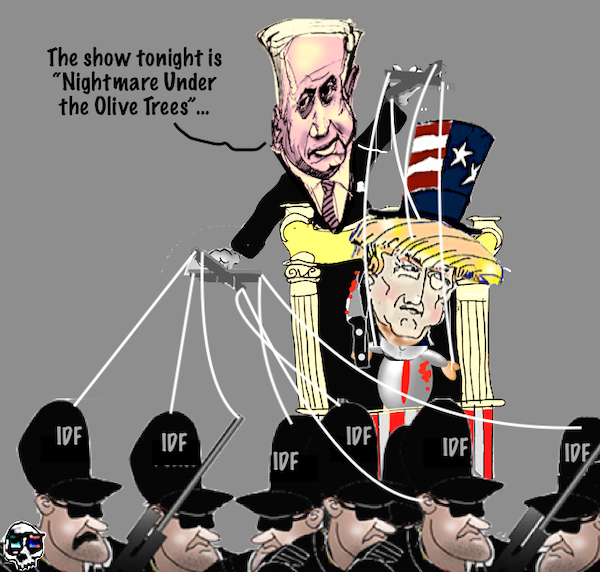

On Sunday [23 NOVEMBER 2025] night, Israeli forces stormed the Palestinian National Theater, El-Hakawati, in occupied East Jerusalem, shutting down a children’s musical show titled “Dreams Under the Olive Trees.” |

|

MacroBusiness

Saturday, November 29, 2025 - 20:55

Source

Australian exports Bridging Visas in Australia Australia International Students Australia CSIRO Funding Australian Inflation – Market and Fixed Australian Electricity Global top 10% incomes – note Australia Australian Ancestry – it appears 90% of us are doomed to be white Australia Housing Credit Australia Government The post Chartfest: 29 November 2025 appeared first on MacroBusiness. |

The Tally Room

Saturday, November 29, 2025 - 19:00

Source

6:00 – Polls have just closed for the by-election for the state seat of Hinchinbrook in the north of Queensland. I will be doing a few updates through the night and may decide to do a video for Instagram and Tiktok later tonight, but I don’t expect it to be the most intense election night. If you’re looking for something to read while you wait for results to come in, you can check out my guide. |

|

Your Democracy

Saturday, November 29, 2025 - 11:43

Source

The European Space Agency (ESA) will begin working on defense projects for the first time, in a move it is describing as “historic.” A resolution by its 23 member states says the agency has the tools to develop space systems “for security and defense.” |

THE BLOT REPORT

Saturday, November 29, 2025 - 11:42

Source

I read an article a day or so ago, mostly about the development of a new type of battery in China, which it was said could give your average electric vehicle (EV) a range of about 1,000 kilometres1. |

|

THE BLOT REPORT

Saturday, November 29, 2025 - 11:28

Source

|

THE BLOT REPORT

Saturday, November 29, 2025 - 11:22

Source

|

|

MacroBusiness

Saturday, November 29, 2025 - 11:00

Source

Gunnamatta.Molva · Deet T – Australian economy, market volatility, the AI wave, Crypto and investment flows Against the backdrop of recent market volatility Deep T talks about asset bubbles and investment as the AI wave enters the national consciousness. Over the course of just under an hour he covers the relationship between investment, productivity and The post MB Radio: Deep T and G on market volatility appeared first on MacroBusiness. |

Your Democracy

Saturday, November 29, 2025 - 09:01

Source

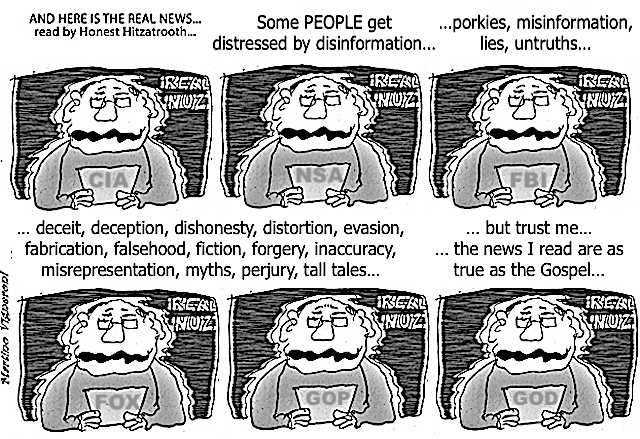

People clinging to falsehoods is not a failure of intelligence, but a deeply human attempt to protect emotional stability in an overwhelming world. |

|

Your Democracy

Saturday, November 29, 2025 - 06:20

Source

Shortly after 3:46 p.m. Doha time on September 9, Osama Hamdan received a call from a journalist asking him if he knew anything about the explosion that had just taken place in the Qatari capital. The senior Hamas leader was at a meeting across town from the Islamic resistance movement’s offices on Wadi Rawdan Street in the upscale Legtaifiyah District.

Weapons of Willpower: Hamas and Islamic Jihad on Trump's Gaza Plan |

Your Democracy

Saturday, November 29, 2025 - 06:00

Source

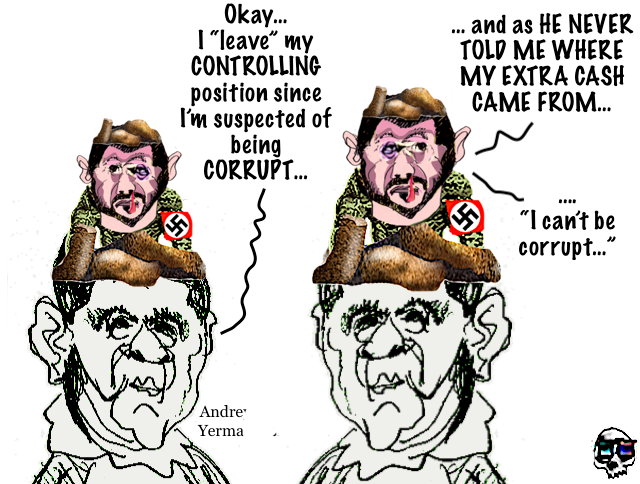

Andriy Yermak’s exit as President Volodymyr Zelenskyy’s all-powerful chief of staff is a tectonic shift for Ukraine that sets the stage for a fierce battle over how the country is governed. |